Protect and grow your stock portfolio in as little as 10 minutes a day

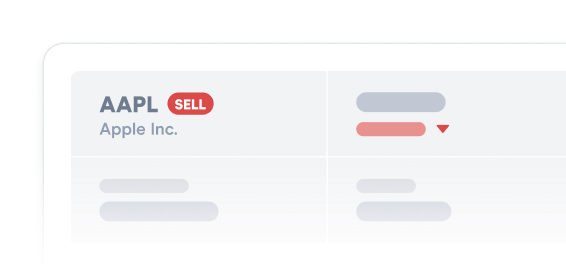

VectorVest analyzes 18,000+ stocks daily and gives a simple buy, sell, or hold rating on each, enabling anyone to make consistent, reliable profits from the stock market.

For a limited time, try VectorVest for

30-days for

only $9.95. Cancel anytime.

Protect & grow your stock portfolio in only 10 minutes a day

VectorVest analyzes 16,000+ stocks daily and gives a simple buy, sell, or hold rating on each, enabling anyone to make consistent, reliable profits from the stock market.

For a limited time, try VectorVest for only $9.95.

NASDAQ Powered Data. VectorVest Trusted Results.

Celebrating 36 years and the trust of over 1 million investors, VectorVest is proud to announce a landmark partnership with Nasdaq! This collaboration brings real-time Nasdaq data directly to our platform, fueling our industry-leading analysis with even greater precision.

What does this mean for you?

- More accurate price quotes translate to sharper insights from VectorVest’s core algorithms.

- More timely entry and exit points, along with pinpointed market timing calls.

- Faster stops within VectorVest’s advanced trading stop signals.

Gain an edge in the tech-heavy Nasdaq – a market known for its fast pace and frequent trading. With VectorVest’s enhanced accuracy, you can navigate it with confidence.

Unlock the power of real-time data

“I originally got this app as a “2nd opinion” brokerage app to determine if Robinhood’s stock ratings were viable or not.”I’ve made +27% in the past 4 months.

I have been using VestorVest for a number of years and am averaging 30% annual returns. VectorVest is instrumental in my success.

I’ve been with VectorVest +10 years and took their course that covers Spread Trading. The next 12 months I pocketed over $110,000 trading SPX only while risking only $20K at any one time.

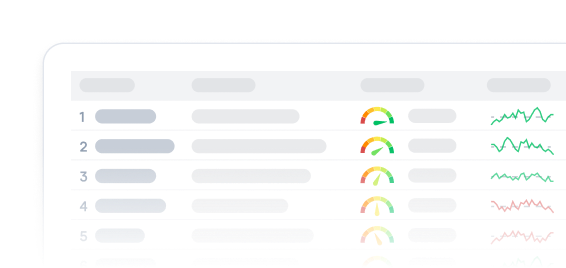

The world’s most advanced market timing signals, and features designed for all investors.

You can’t predict the market, but our cutting-edge market-timing signals and exclusive VST™ ratings enable you to capitalize on upswings and steer clear of downturns.

Designed by PHD Mathematicians

Utilizes advanced statistical models for robust data-based decisions, not merely the opinion of a broker or manager.

Packed with Features

Including deep analysis on 18,000+ stocks, customizable search, watchlists, email alerts and much more.

Integrates with Trading Platforms

Integrates with popular brokerage accounts for complete all-in-one portfolio management.

Expert Education

A wealth of resources, including daily coaching groups to follow real-time software interpretations and trades.

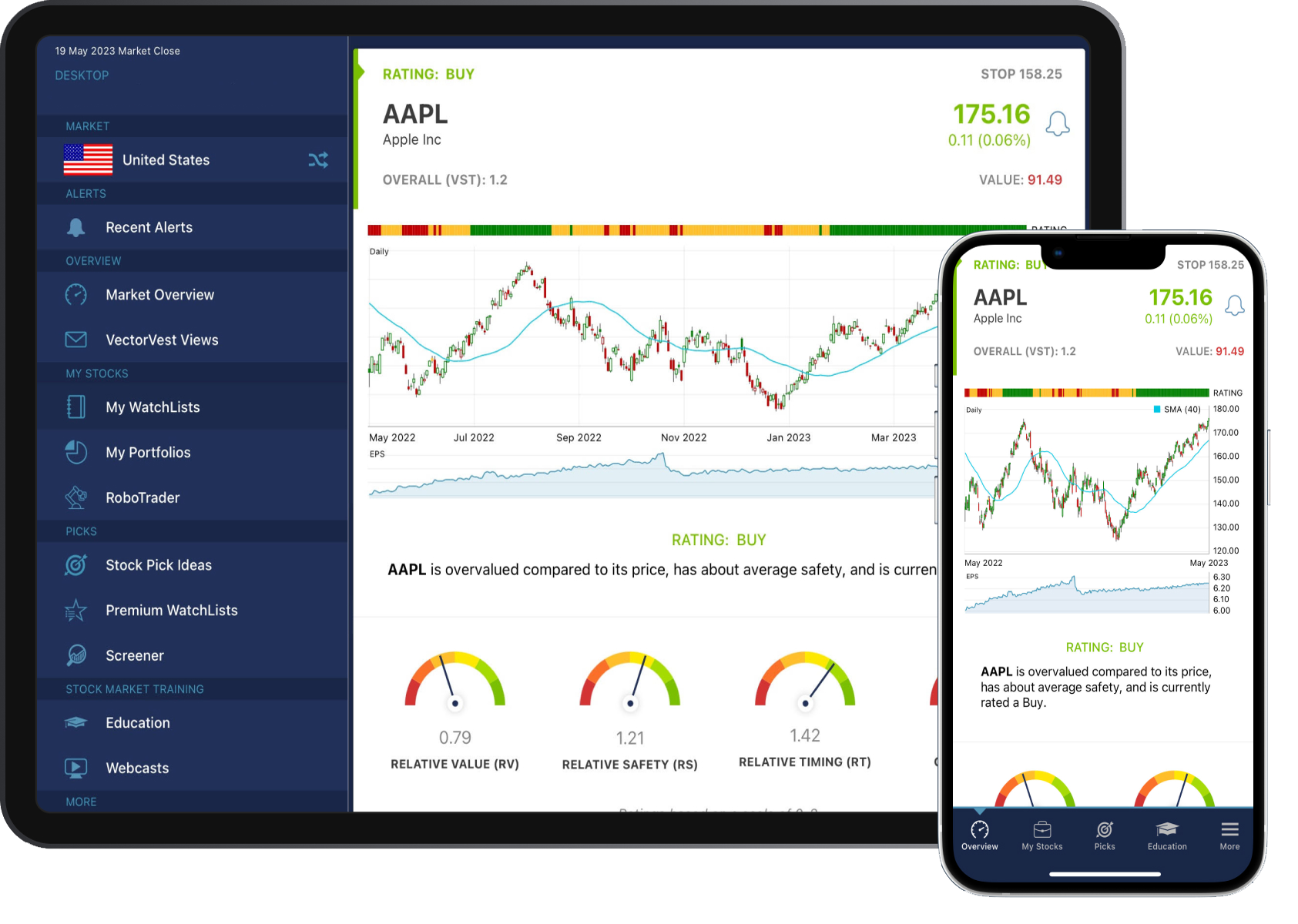

Desktop & Mobile App

Manage your portfolio in minutes a day, from anywhere, with our mobile app.

Excellent Support

Free U.S. based live support to help you trade confidently and realize consistent results.

-

Designed by PHD Mathematicians

Utilizes advanced statistical models for robust data-based decisions, not merely the opinion of a broker or manager.

-

Packed with Features

Including deep analysis on 16,000+ stocks, customizable search, watchlists, email alerts and much more.

-

Integrates with Trading Platforms

Integrates with popular brokerage accounts for complete all-in-one portfolio management.

-

Expert Education

A wealth of resources, including daily coaching groups to follow real-time software interpretations and trades.

-

Desktop & Mobile App

Manage your portfolio in minutes a day, from anywhere, with our mobile app.

-

Excellent Support

Free U.S. based live support to help you trade confidently and realize consistent results.

+2,139%

+209%

We’ve consistently outperformed the S&P 500, achieving a 15% average annual return for two decades

And not only the S&P 500, we’ve beaten every major stock market index. Don’t just take our word for it—verify this yourself during your trial by backtesting every recommendation we’ve made.

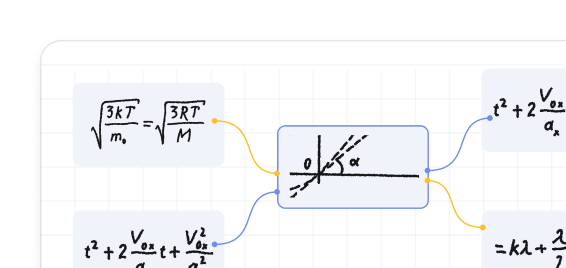

How to use VST™ ratings to grow your portfolio in as little as 10 minutes a day

Our exclusive VST™ (Value-Safety-Timing) ratings distill hundreds of data points into clear buy, sell, or hold recommendations for every stock. This makes trading impossibly simple, ideal if you’re new to investing or learning to manage your own portfolio.

Here’s how it works:

If you’re a seasoned investor, or developing your skills:

VectorVest offers limitless opportunities for learning, growth, and portfolio management through deep data, insights, and educational resources.

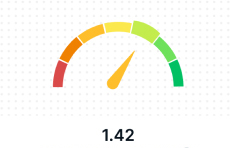

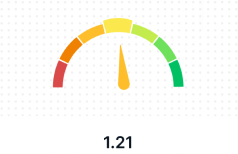

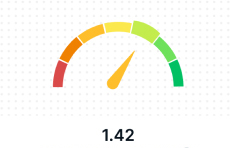

Our VST™ rating (from 0 to 2)

OVERALL

RELATIVE VALUE

RELATIVE SAFETY

RELATIVE TIMING

Excellent set of tools… I consistently beat all my professionally managed accounts. Really can’t imagine not having them part of my daily routine.

Using the VectorVest tools I made over $32,000 in less than two weeks on one trade. Subscribing to VectorVest is the smartest investment decision that I have made.

With this tool I can check any stock and make the right call most of the time. It has simplified things for me. My portfolio is going gang busters.

You can’t predict the market, but you can ride the rallies and dodge the downturns.

While it’s impossible to predict the market, VectorVest alerts you to swings so quickly you’ll feel like you’re peering into the future. The chart below shows our buy and sell signals at major market turns dating back to 2000.

Mar 20, 2000 – RELATIVE VALUE (RV)

NASDAQ surged 400% in 5 years but crashed 78% from its peak in Oct 2002. VectorVest advised subscribers to exit the market on Mar 20, 2020, securing gains and outperforming buy-and-hold by over 226%.

Mar 17, 2003 – Buy Recommendation

The Dotcom bubble bursting led to a several year bear market. VectorVest made a buy recommendation as momentum shifted and the market rally began.

Nov 2, 2007 – Sell Recommendation

VectorVest advised investors to move to cash on Nov 11, 2007 or to begin shorting the market. Average 19% gains by mid-summer of 2008.

Mar 9, 2009 – Buy Recommendation

VectorVest sees the shift in momentum after the mortgage meltdown and makes a Buy recommendation at the start of one of the longest bull runs in market history.

Feb 21, 2020 – Sell Recommendation

Coronavirus shutdowns erased nearly 11,000 points (roughly 37%) from the DJIA. While nobody could predict the shutdowns to occur VectorVest advised investors to tighten stops and take profits on Feb 21, 2020.

Mar 25, 2020 – Buy Recommendation

VectorVest identified upward momentum and advised investors to buy stocks long, setting subscribers up for one of the fastest market recoveries in history.

Nov 22, 2021 – Sell Recommendation

Record-high inflation and increasing interest rates triggered a stock market decline. VectorVest’s Nov 21, 2021, advice to shift to cash shielded its subscribers from the impact, and those who utilized its shorting tactics made gains of up to 93% in just six months.

I’ve more than doubled my Options account as of August 2021; over 100% gain. HIGHLY recommend VectorVest. Customer service is outstanding. Seminars and software, OUTSTANDING.

I have a strong and positive view of VectorVest. Joined after the crash of 2020. Long story short, I made enough money in June to December 2020 using VV to pay off a large mortgage.

I have had very good success with VectorVest. I’ve made 50-60% returns annually for the last 6 years with their systems. All I can say, if you follow them to a T you will succeed.