Written by: Angela Akers

As they have done for the last year, the Federal Reserve moved last week to leave interest rates unchanged at the elevated rate of 5.25% – 5.50% and signaled only one cut this year. That same morning, the May Consumer Price Index was released, coming in at a lower-than-expected increase of 3.3%. Additionally, Q1 earnings season is wrapping up and according to FactSet, S&P500 earnings growth came in at a healthy 13.3%.

Being VectorVest subscribers, we know that earnings, inflation and interest rates are the three most powerful factors affecting stock market movement. However, there is another force that drives the stock market that may overrule the power of earnings which comes along every four years and that is the Presidential Election Cycle. Whether earnings are rising, as they are now, or falling, matters a little less due to political forces that are motivated to boost the economy in pursuit of a reelection of the incumbent administration.

According to Hirsch and Mistal’s Stock Trader’s Almanac for 2024, history has shown that the performance of the stock market during the last two years of a presidential term is far better than that of the first two years. “It’s no mere coincidence that the last two years (pre-election year and election year) of the 48 presidential terms since 1833 produced a total net market gain of 772.0%, dwarfing the 336.5% gain of the first two years of these terms.”*

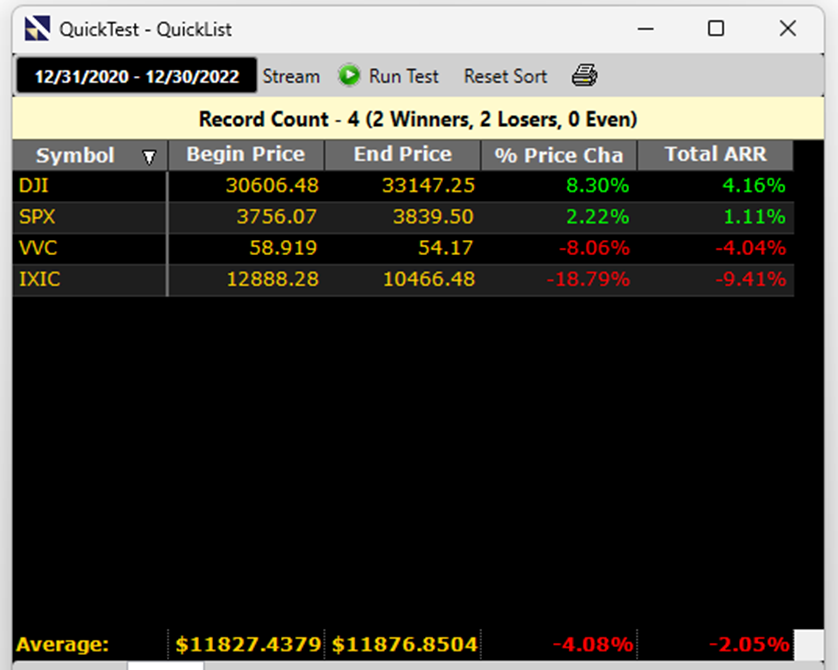

Is this true for President Biden’s current term? Let’s take a look. Here is how the Major Indices and the VectorVest Composite fared in the first two years:

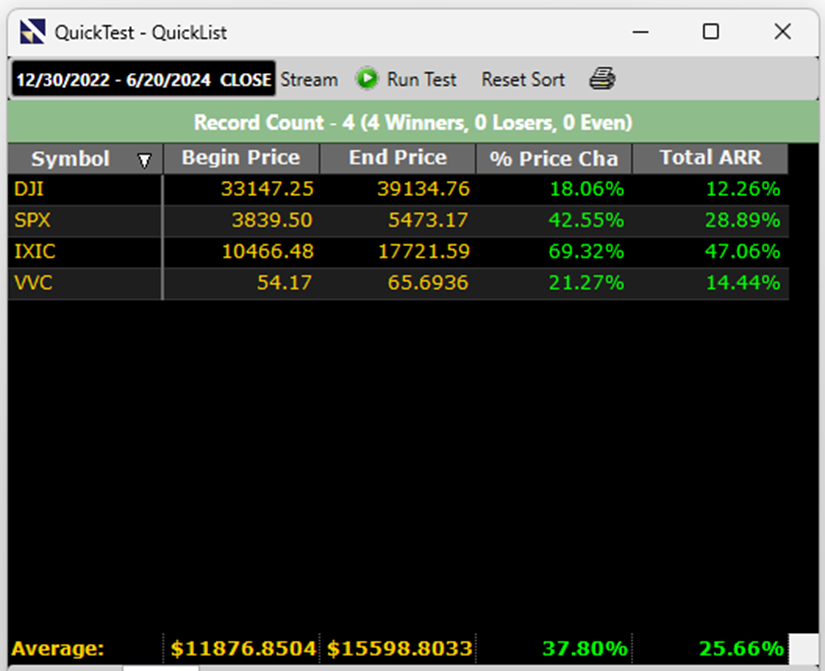

Here is the last two years thus far:

So, for all of the Major Indices and the VVC, it seems the Presidential Election/Stock Market Cycle has held true to the theory during the current administration.

I read an article on Yahoo! Finance last week entitled, “A cooler inflation number amplifies the political pressure on Jerome Powell.” And it got me thinking… we’re just a little under 5 months until the November 5th Presidential Election takes place and I wonder if this “political pressure” will ultimately affect the Federal Reserve’s next two interest rate decisions.

It will be interesting to see how the next several months play out between The Presidential Election Cycle And The Fed.

PS. While the Presidential Election Cycle is interesting and informative, VectorVest believes that our subscribers are better served sticking with a combination of fundamental and technical analysis. Make sure that you check out tonight’s “Special Presentation,” where Mr. Ryan Shook will show you how to find the hottest sectors and industries to help you make money as we lead up to the election.

* Hirsch and Mistal, Stock Trader’s Almanac 2024, Pg. 132

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment