As we reflect on the two consecutive months of stock declines and an intensifying trade standoff, we spring forward, remain focused, and stick to our rules on finding new opportunities to invest.

The rule of rules: Pick safe, undervalued stocks, rising in price.

An Investment in Knowledge Pays the Best Interest

Dallas-based Cambium Lrn (ABCD) is an award-winning educational technology solutions and services company. The stock price closed on April 5 at $11.33 and gained 3.09% in the last trading day, rising from $10.80 to $11.33. We think the stock has a current value of $17.11 per share which is undervalued compared to its price of $11.33.

On March 7, 2018 Cambium posted their 4th Quarter 2017 Financial Results and annual sales increased 4% over the last 12 months to $158.2 million. On the 2018 outlook, John Campbell, CEO of Cambium concluded:

“Our 2017 results show our continued focus on increasing cash generation and the long-term value of the company. For 2018, we expect improved top-line growth, coupled with disciplined expense management, while investing in development, marketing and sales, should drive continued expansion in our Cash Income, Adjusted EBITDA, and cash flow generation. …we are poised and ready to execute well and to deliver strong financial results in 2018.”

Leading 12-month forecasted earnings are $0.59 per share and earnings are forecasted to grow at 37% per year, which we consider to be excellent. With an excellent combination of upside potential and financial performance, this stock is suitable for Prudent Investors.

High Growth, Industry Leading HealthCare Company

Centene Corporation (CNC), a St. Louis, MO company, provides high-quality, culturally sensitive healthcare coverage and a wide range of specialty services. Centene is one of the largest managed care providers in the US, serving over 23 million people in 14 states.

CNC is undervalued compared to its price of $107.20 and has an above average safety rating of 1.46 on a scale of 0.00-2.00. Centene provided a 2018 outlook at their December 2017 event with adjusted EPS of $5.47 to $5.87. We give CNC forecasted EPS of $5.94 per share and an earnings growth rate of 20.00%, which VectorVest considers to be very good.

This stock is suitable for prudent investors, with an RS rating of 1.46, which is excellent. RS is an indicator of risk and CNC shows minimal risk to investors as this company has excellent financial performance. CNC has excellent growth potential with a RV rating of 1.51. RV is an indicator of long-term price appreciation potential.

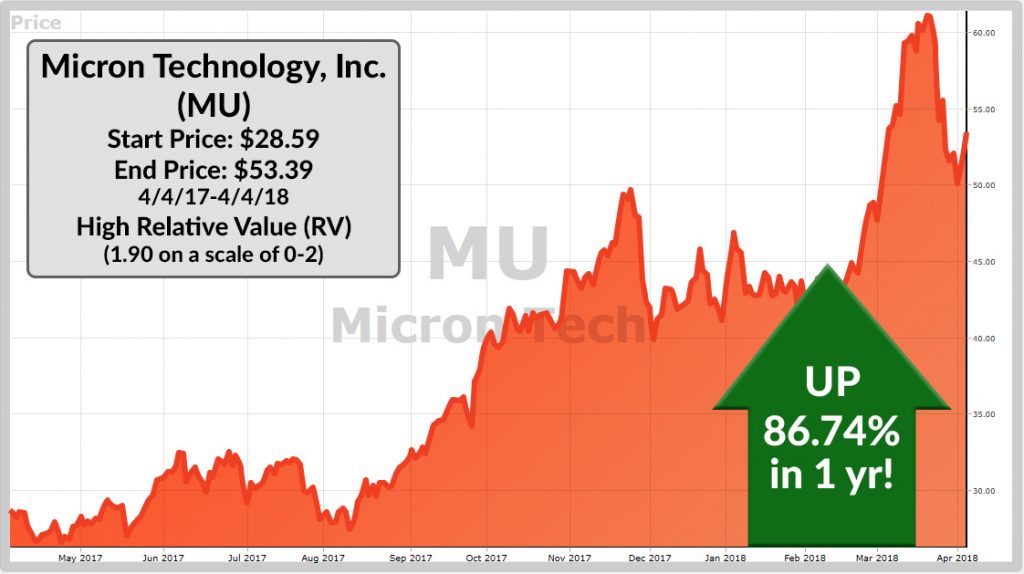

Micron Isn’t Done Growing

Micron Techology, Inc., (MU) is a manufacturer and marketer of semiconductor devices. As of April 6, shares are rallying in morning trading, with the stock up 0.8%. Micron shares are up 86.7% in the last 12 months. MU has a current value of $98.51 per share, which is undervalued compared to it’s price of $50.27 per share. We rate these shares as having excellent growth potential with a RV rating of 1.90.

Microns’ shares fell after the earnings report published on March 22 as investors were probably looking for bigger guidance numbers but we see no reason for investors to panic. Micron’s fiscal 2nd-quarter revenue shot up 58% year over year to $7.35 billion and net income tripled to $3.5 billion. Micron attributes this incredible growth to the stong demand for its DRAM and NAND flash memory chips.

Micron Technologies has a forecasted earnings per share of $9.74 per share and a forecasted earnings growth rate if 44.00%, which VectorVest considers to be excellent. We currently rate this stock a buy.

We found all these stocks by using VectorVest 7 Stock Viewer in less than 10 minutes. It gives us world-class stock analysis with just a few clicks of the mouse and keeps investors up-to-date on rapidly changing market conditions.

If you are looking to learn how to take advantage of volatile market conditions, check out our Swing Trading with Success Live Webinar Event. We’ll provide all the education and tools necessary to become a successful Swing Trader.

I would like to see the Swing Trading with Success webinar, but I will be at work and need to know if it will be archived for me to view later. I am a subscriber for over 10 years.

Hello David Kercheval. The Swing Trading with Success webinar will be available to view online 2 weeks after the event. Please call our customer support line for more information on how to access.

It is extremely important for investors to review the guidance (esp. revenue and EPS guidance) before making any investment decisions, as their investment returns depend on the upcoming revenues and earnings.