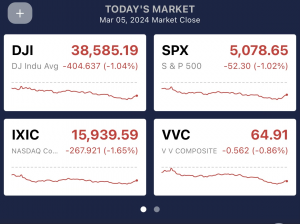

Day-to-day market observations can be exhausting when the markets were red on March 5th, then extend significant gains in the early session on March 6th. The losses experienced yesterday can be attributed to Apple and Tesla’s disappointing news alongside mixed data from the US. Although the US market has seen extended gains in the first few months of the year, yesterday, Dow Jones extended losses over 400 basis points to -1.04%, while the S&P extended losses over 40 basis points to -1.02%. Let’s jump into the details, the movements, and what’s causing market sentiment to shift.

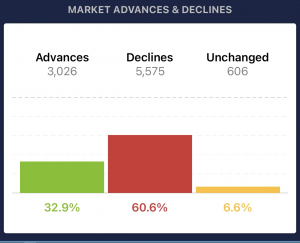

Taking a look at the VectorVest analytics, it’s clear to see the poor performance on the market yesterday, alongside decliners dominating over the advancers; Which demonstrates not only the power of the Magnificent 7, but market sentiment.

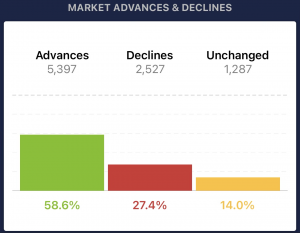

On March 6th, an hour into the trading session, the market extended gains due to a strong earnings report from CrowdStrike last night after the close, Fed Chair Powell’s speech, positive comments from Canada regarding the US’s strong economy, and more. The reversal was quick, so let’s see what sent it there in the first place.

What happened with Apple?

Apple (AAPL) declined by -2.84% due to reports of declining sales in China. Coming from the Counterpoint Research data it was stated that iPhone sales were down 24% in China during the first six weeks of 2024. On the reverse, Android sales were significantly up from prior yearly readings. The news came with the realization that Apple is now in 4th place among smartphone vendors in China. Obviously, the news sent the stock down with no clear plan to instigate, followed by the company affirming a decrease in revenue for the first quarter due to the “traditional off-peak season.” Investors didn’t buy it, and the company is still pairing gains.

What happened with Tesla?

Environmental activists set Tesla’s (TSLA) Berlin Gigafactory in Germany on fire, causing the stock to dip 3%. The fire was initiated after Tesla announced plans for expansion at its Gruenheid plant, which had already been triggering environmental activists and damaged the plant. The company came out with a statement that it was unsure of when production would resume due to extensive damage and power failure.

What happened with the data?

Data on January 5th came in mixed, with January factory orders missing estimates of -2.9% and coming in at -3.6%. January durable goods orders were reported just below estimates of -6.1% and coming in at -6.2%. Most significantly, the February ISM services index came in below estimates of 53.0 at 52.6, with prices paid coming in far below estimates of 62.0 at 58.6. The takeaway? Some misses were stronger than others and contributed to the dip yesterday.

How VectorVest Helps

The market’s immediate and often emotional reaction to unpredictable news can skew the market outlook for a day, week, or even months at a time. What’s worse is the impact it can have on the trajectory of a company, and data is never truly predictable. No one could have predicted the events in Germany, and the shift for Apple is surprising due to their overall global dominance.

If the market's uncertainties are difficult to navigate, VectorVest is a tool for you. VectorVest provides data-driven recommendations on potential investments and strategic timing regardless of events. VectorVest helps investors navigate the uncertainties associated with economic growth or downturns, ensuring a more informed and stress-free investment approach.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action.

Leave A Comment