Written by: John LinDahl

What are these things called “options”? What is the mystique about them and are they as risky as people say? There are lots of myths about options and how they are supposed to be dangerous. While every investment contains risk, if used correctly, options can reduce risk and increase profits. Options can provide the following benefits when used correctly:

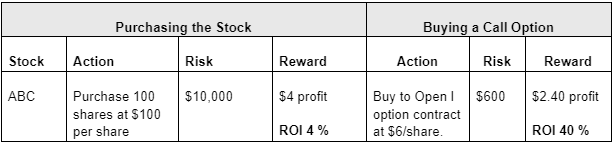

- Control shares of an equity at a lower cost – Options are contracts between a buyer and a seller. One contract controls100 shares of an equity. As an example, if a stock were selling at $100 per share, 100 shares would cost $10,000, however, controlling the same amount of shares via 1 option contract might only cost $600 if a call option priced at $6 is purchased.

- The Return on Investment (ROI) is greater than purchasing the equity. The ROI will be greater because the original investment is significantly smaller.

- Reduced Risk – Options can be used to mitigate risk on the equity that is owned. For instance, if you own 1000 shares of Stock ABC that you want to hold long term, the market goes into a downtrend, but you do not want to sell the stock, so you could buy put contracts to mitigate the downtrend.

Table 1 delineates a comparison of the risk and reward involved in owning a stock versus using a call option. In this example the stock makes a gain of $4. The option’s behavior and reward are governed by the delta and gamma factors (Greeks) that will be discussed in greater detail in a future session. The delta is defined as the amount that an option will increase in value by a $1 move in the stock price. The gamma is defined as the amount that the delta will increase for a $1 move in the stock price. The delta value for Buying to Open an ATM option is around 0.5. That means that for a $1 increase in the stock, the option will rise by 50 cents. As the stock continues to rise, the gamma factor will increase the delta factor. This is how the ATM option gained $2.40 in value.

Table 1. Risk Reward Comparison. Buying to Open an option provides the Buyer with a lower risk and higher ROI than purchasing the stock.

Over the next weeks, we will be discussing the makeup of options and addressing strategies that can be used in the differing market conditions. Today, we want to provide you with some basic knowledge and terminology that will be used as we go forward.

Types of Options

There are two types of Options instruments, Calls and Puts.

- Call Option – If a bullish (stock is going up) view existed on an equity, you would buy a Call Option. If the position were bearish (stock is going down), you would sell a Call Option

- Put Option – If a bearish view existed on an equity, you would buy a Put Option. If you were bullish on an equity, you would sell a Put Option.

Options Elements

All options contain the following key elements:

- Expiration Date – Unlike equities, options have expiration dates. Monthly options expire on the third Friday of the expiration month. Stocks that have weekly options expire on the Friday of that week.

- Strike Price – There are multiple options for an equity within each expiration date. The options can be purchased At the Money (ATM), In the Money (ITM), and Out of the Money (OTM).

Data for an option is found in an “Option Chain” as illustrated in Figure 1. Brokerage firms provide these chains on your trading platforms. This option chain is for Microsoft (MSFT). The far-left column indicates the different expiration dates. The next columns indicate the different strike prices, the bid and ask prices, open interest, the Greeks, and the volatility.

Figure 1. Option Chain for MSFT. The option chain contains essential information for selecting your strike price and expiration date for an option.

An ATM option means that the underlying equity is equal to or close to the strike price of the option. As an example, if a stock is priced at $99.35, the $100 strike price would be considered At the Money.

An ITM option means that the stock price for a call option is greater than the strike price of the option. As an example, if you buy a call option with a strike price of $100 and the stock price is at $102, the buyer is $2 In the Money. Similarly, if you bought a put option at a strike price of $100 and the stock price was $97, you would be $3 In the Money.

An OTM option means that the strike price has not yet reached the value of the underlying equity. As an example, if you buy a Call Option with a strike price of $100 and the stock price is at $95, you are considered Out of the Money. Similarly, If you bought a put contract at the $100 strike price and the underlying equity is at $95 you would be considered Out of the Money.

Rights and Obligations

Options traders have Rights and Obligations when buying and selling options as described below:

- Call Option – A buyer of a call option is bullish and would buy a call option. This provides the Buyer with the Right to purchase the equity at the strike price on or before the expiration date. As an example, if a Call Option Buyer buys an ATM option where the equity was at $100 and the equity rose to $112, the buyer would have the Right to Buy the equity for $100 and would immediately have a $12 profit. The Call Option seller is Obligated to sell the equity at $100 and has a loss of $12 per share.

- Put Option – A buyer of a Put Option is bearish and would purchase a put option. This provides the Buyer with the Right to sell the equity for the value of the strike price on or before the expiration date. A seller of Put Option is bullish and is Obligated to buy the equity for the dollar value of the strike price if assigned.

When buying and selling options, we use the following terminology.

- Buy to Open (BTO) – This term indicates a buyer opening an option trade and either purchasing a call or put option contract.

- Sell to Close (STC) – This term refers to a buyer who is now ready to close the position by selling the call or put option.

- Sell to Open (STO) – This refers to a person opening a call or put position by selling the call or put versus buying it.

- Buy to Close (BTC) – This term refers to a person who has sold an option and now wants to close out the trade by buying it back at a price lower than that for which it was purchased.

There are many additional factors that are involved with options. As we move forward in this series of articles, we will discuss topics such as assignment, volatility, intrinsic and extrinsic value, the Greeks, the use of spreads, and provide examples of different trade strategies that can be used In varying market conditions.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment