Written by: Angela Akers

The Federal Reserve delivered a 50-basis point rate cut this week, which was unexpected until a few days ago. Fed Chair Powell was clear that the Fed is “committed to maintaining” economic strength. The heftier-than-anticipated cut came in the wake of a revision to the jobs data and concern over potential weakness in maintaining full employment (part of their dual mandate). The initial reaction was good, stock prices shot higher, but see-sawed into the close, finally ending lower. News of the rate cut spread, reality set in and sparked a solid rally Thursday.

In last week’s Essay, we reviewed a simple dividend strategy because investing for income with dividend payers becomes an attractive avenue as interest rates fall. I wondered what other strategies investors could employ to make money in a falling interest rate environment. Of course, as I said last week, the talking heads have suggested housing stocks, tech stocks, small caps, high yield ETFs, etc. While all that is fine and good, I like to deal in reality, not speculation, so I turned to VectorVest for help.

Another approach one might employ is simply to buy rising stocks in rising Business Sectors. The key to doing this is Relative Timing, RT. RT is a fast, smart and accurate indicator that analyzes a stock’s price trend, or in the case of Business Sectors, a group of stocks’ price trend. Business Sectors are comprised of related Industry Groups. For example, the REIT Business Sector is made up of 2 Industry Groups, REIT (Equity) and REIT (Mortgage).

All Business Sectors and Industry Groups may be analyzed, sorted and ranked in the same way that stocks and ETFs are, but with a few important differences; they are ranked by RT Desc (instead of our default, VST Desc), they do not have a “B, S or H” rating, but they do have an RT Ranking. The RT Ranking allows us to know exactly where a Business Sector or Industry Group stands compared to the other Sectors or Groups according to their RT level.

Where do we find rising Business Sectors? Simple, the top 5 Sectors ranked by RT are conveniently located on your VectorVest 7 Homepage, making it easy to see the fastest moving Sectors and keeping the relevant stock movement at the forefront. In those Sectors, one should focus on the fastest moving stocks. Let me explain further.

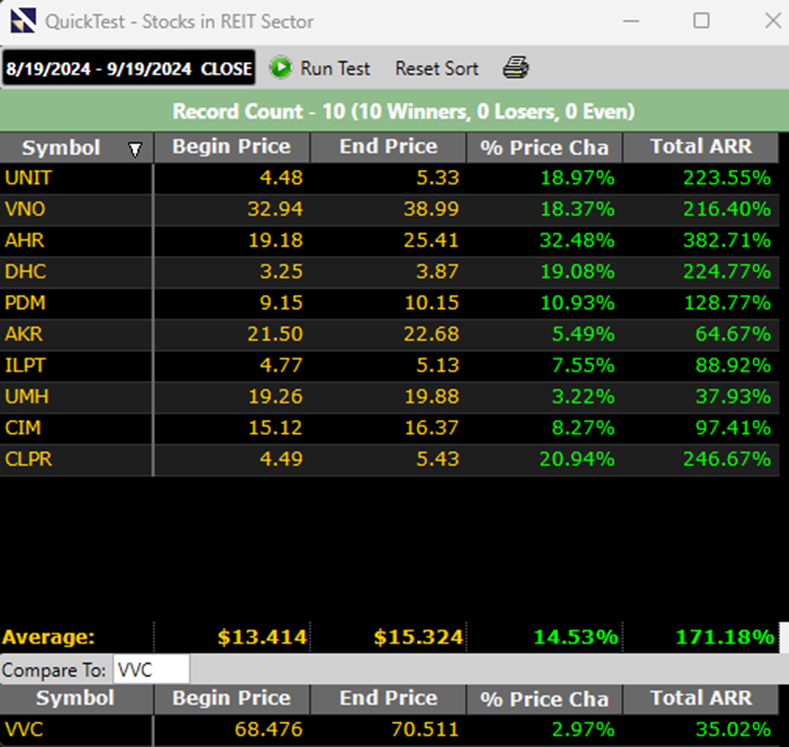

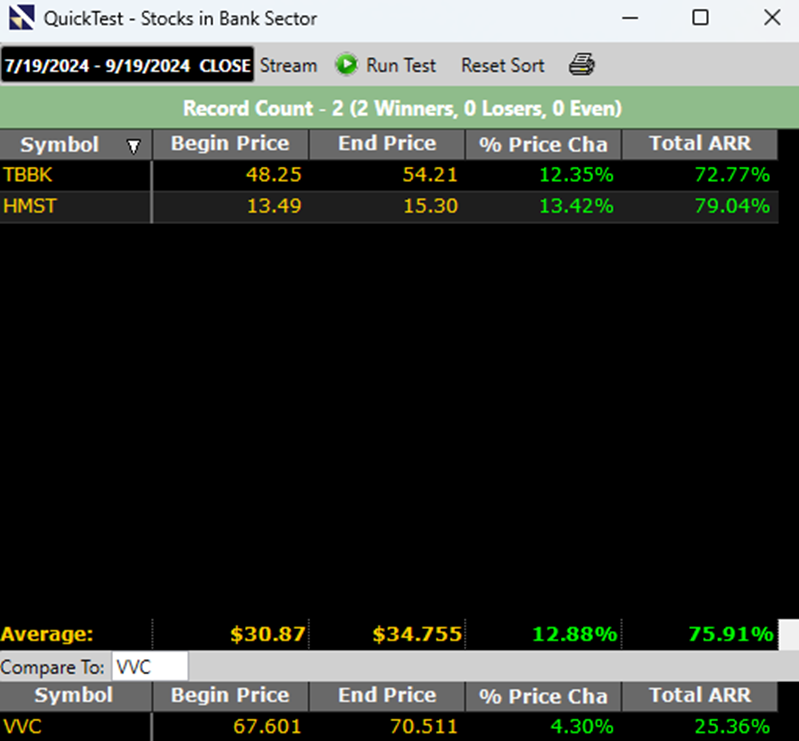

Click on the Viewers tab and select Sector Viewer. You will notice, as described above, the Sector Viewer is sorted by RT Desc. I clicked on the date box and changed the date to July 19, 2024 (this shows me the top RT Business Sectors that would have been listed on the Home Page as of that day). The top Industry was banking and I right clicked and selected View Stocks in Business Sector. Once the list of Stocks popped up, I changed the sort to RT DESC. I then QuickTested the top 10 stocks through last night’s close.

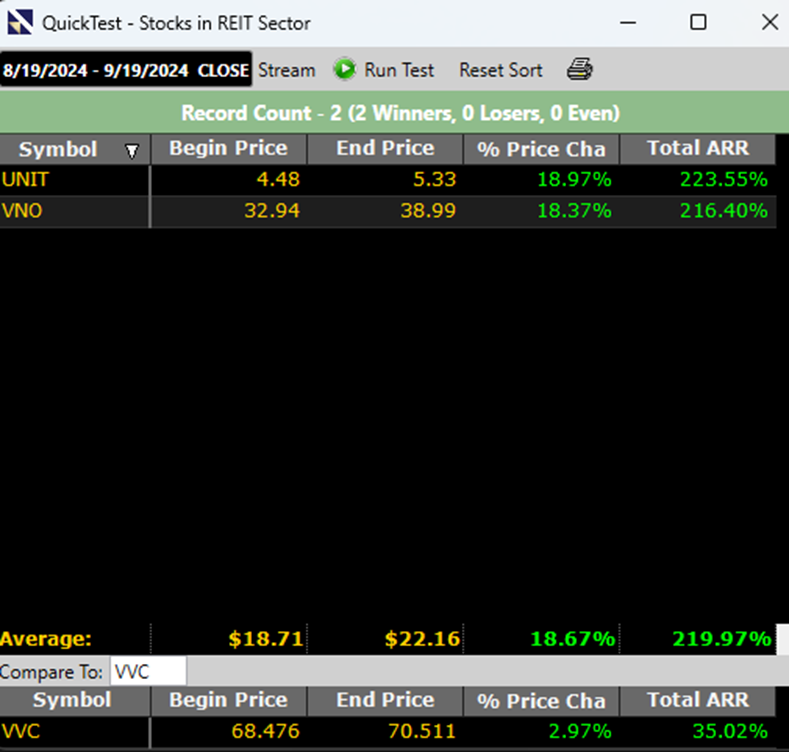

Going back to the Sector Viewer, I updated the date to August 19, 2024, and repeated the process. However, since the Bank Sector was still at the Top, I tested the second highest Sector, REIT.

It is important to note that a diversified portfolio is one of the keys to successful investing. Hence, one should only consider picking up a couple of stocks in each Sector. The top 2 RT stocks in each Business Sector would be prime choices in both cases.

Keeping our eye on the fastest moving Business Sectors will allow us to see what sectors are cooking, and therefore, what stocks are heating up as the Fed ushers in more interest rate cuts throughout the rest of this year and into the coming year. It will give you a bird’s eye view of What Sectors Will Benefit From Rate Cuts.

PS. In this week’s “Special Presentation,” Mr. Steve Chappell is going to demonstrate another way that VectorVest can help you identify the hottest strategies and stocks. You DO NOT want to miss it!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment