Written by: Angela Akers

The financial world and talking heads were all a buzz this week about what the economy would look like under Harris versus Trump following Tuesday’s debate and what companies would be a good investment in that regard. Also discussed, the upcoming Federal Reserve meeting where the Fed is widely expected to cut rates by 25 BP and what companies would be a good investment in a lower interest rate environment. The talking heads spoke of housing stocks, tech stocks, small caps, high yield ETFs, etc. Nevertheless, I didn’t hear much, if any, talk about dividend paying stocks which I thought was odd because historically, dividend paying stocks tend to do well as rates fall.

Recently, I came across an article in Newsweek titled “The 15 Best Dividend Stocks of September 2024: Increase Your Cash Flow With High-Yield Gains.” I recognized most of the companies listed in the article as heavy hitters with names like Microsoft, Visa, Broadcom, JPMorgan, etc. Still, as I always do, I decided to put them to the test with VectorVest.

Touted as the “Best Dividend Stocks of September,” I was very interested to know how the VectorVest’s Proprietary Dividend Indicators ranked them. For your convenience, I created a WatchList and added it to the OverView WatchList group and named it “Newsweek’s 15 Best Div Stocks of Sept 2024.” Now, when considering which dividend paying stocks to add to your portfolio, you should ask yourself these two important questions:

How safe are the dividends?

How fast are the dividends growing?

VectorVest answers these two questions objectively and systematically with the Dividend Safety and Dividend Growth Proprietary Indicators. As a reminder, DS is an indicator which assesses the assurance that regular cash dividends will be declared and paid at current or higher rates for the foreseeable future. It is graded on a scale of 0 – 99 with values above 50 being favorable and values below 50 being unfavorable. DG reflects a forecasted annualized growth rate of a company’s dividend based on historical dividend payments and dividend predictability. DG looks toward the future.

According to the WatchList Average as of last night’s close, Newsweek’s 15 Best Div Stocks of Sept 2024 ranked fairly well with a DS of 71 and DG of 11. Thirteen of the fifteen had a DS greater than 50 and double-digit DG levels. OK, not bad at all. Next, I wondered how these stocks have performed so far this year, so I ran a QuickTest from December 29, 2023 through September 12, 2024. Here are the results:

For reference, here’s how the Major Indices and the VectorVest Composite have fared over the same time period:

So, again, not bad at all. With a gain of 18.15%, the WatchList managed to beat all the Major Indices and the VectorVest Composite. But I was sure VectorVest could help me do better.

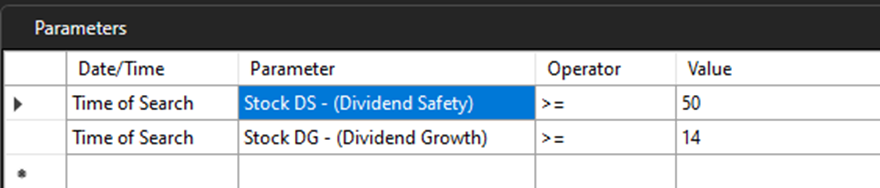

I built a UniSearch with just two parameters: DS >= 50 and DG >= 14.

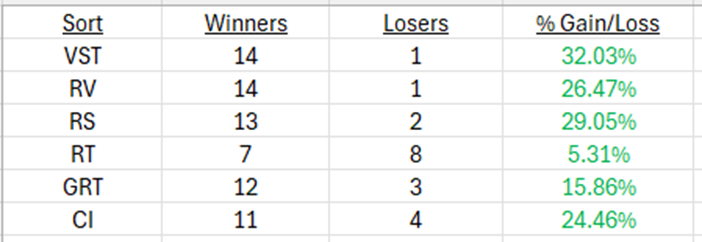

From here, I decided to see which VectorVest Proprietary Indicator sort produced the best results year-to-date. Here is what I found when QuickTesting the Top 15 stocks from this search:

Not surprisingly, four of the six VectorVest Proprietary Indicator sorts were able to beat all the Major Indices, the VectorVest Composite and the Newsweek WatchList with minimal effort on my part and not a lot of time. I’d say this whole exercise only took about 15 minutes.

But VectorVest makes it even easier than that. Join Mr. Jim Penna for tonight’s “Special Presentation,“ where he’ll show you where to find the searches and Trading Systems, already built in VectorVest 7, that will help you maximize your profits while picking up dividend income.

With lower interest rates on the horizon, it is easy to find winning dividend stocks in VectorVest, The Possibilities Are Endless.

Special Note: The results shown above only include the gains from the stock price increases, not the income that you would receive from the dividend payouts.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment