Written by: Angela Akers

Sometimes investing inspiration and ideas spark from random events. This week, I happen to be in North Carolina for our annual VectorVest Christmas party. I was randomly discussing “Christmas colors” over coffee with a colleague and she mentioned that gold was also a Christmas color. I agreed and we moved on. However, the mention of gold led me to think about the Midas Touch technique. The Midas Touch technique was first defined by VectorVest and used as a system for when to enter and exit gold stocks in 2009. It wasn’t long before we realized that the Midas Touch technique could also be used as a method to identify entry and exit points for stocks in general. This technique is centered around two very important VectorVest indicators. These two indicators are Relative Timing, RT, and Stop.

RT is an intelligent measure of a stock’s price trend and is computed from an analysis of the direction, magnitude, and dynamics of a stock’s price movements day-over-day, week-over-week, quarter-over-quarter and year-over-year. A stock is identified as being in an uptrend when RT is greater than 1.00 on a scale of 0.00 to 2.00 and a downtrend when RT is less than 1.00.

RT can also sense momentum changes. Meaning, if a stock’s price is rising, but RT begins to trend lower, RT is revealing a loss in the stock’s upward momentum and signaling that the stock’s price is peaking and/or a turning point may be near. The reverse is also true, if a stock’s price is falling and the RT begins to rise, RT is signaling a loss of downward momentum and a bottom and/or turning point may be near.

The VectorVest Stop price is the other important indicator that is used in the Midas Touch technique. The VectorVest Stop is an indicator of when to sell a position and is computed from a 13-week Moving Average of closing prices and is fine-tuned according to the stock’s fundamentals.

RT and Stop are amazing indicators alone, but their power can be optimized by using a Moving Average. And that is how we use these indicators for the Midas Touch technique.

The Midas Touch technique uses the following rules:

- The 10-Day Moving Average (MA) of the Stop must be above the 65-Day MA of the Stop.

- The 40-Day MA of RT must be above 1.00.

- All three MAs must be hitting three-month highs.

Because this technique has worked so well to identify stocks that are in the midst of a strong uptrend, we created a WatchList of stocks that meet the above criteria called Midas Touch Stocks (found in the WatchList Viewer under the Cherry Picking folder) and it is updated daily.

A QuickTest of the top 10 Midas Touch Stocks by our default sort, VST-Vector, from December 29, 2023 through last night’s close showed a 29.30% gain year-to-date, beating the broad market, as represented by the Price of the VectorVest Composite, by 12.03 percentage points:

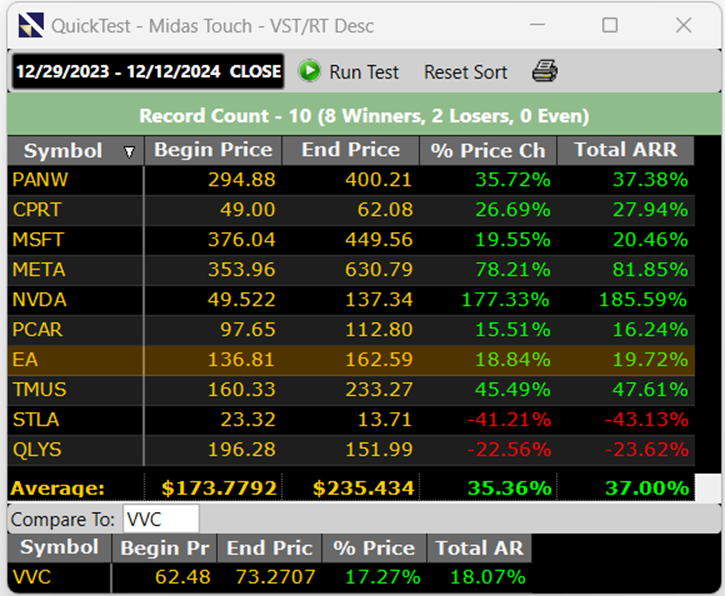

Taking it a step further, I headed over to the UniSearch tool to test one of my favorite searches for Midas Touch Stocks, Midas Touch VST/RT Desc (found in the Searches – Cherry Picking folder). The reason that this is one of my favorites is because of the sort, VST/RT Desc. It brings the Midas Touch stocks that have the best combination of Relative Value, Relative Safety and Relative Timing, but with “lower” RT values to the top. Keep in mind, however, criterium 2 and 3 above. So, while the RT is “lower” with respect to the other Midas Touch stocks, the RT is still above 1.00 and rising. VST divided by RT, brings the stocks to the top that, in my opinion, have more room to run.

I appreciate that this improved my overall results by 6.06 percentage points, but I loved that the stocks with the VST/RT sort had 8 Winners and 2 Losers as compared the 5 Winners and 5 Losers of the VST sort!

The Midas Touch technique easily identifies stocks that are in a strong uptrend, and by using Moving Averages with it, you cut out a lot of the day-to-day volatility. That’s what Moving Averages do, they help to quiet the daily noise of up and down moves. It’s The Magic Of Moving Averages.

PS. If you want to know more about Moving Average Magic, join our Moving Average Mage, Mr. Jerry D’Ambrosio for this week’s “Special Presentation.”

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment