Written by: Angela Akers

“Plan your trade and trade your plan” is a saying I’ve heard many times working in this field. While it’s not easy to nail down exactly who came up with that saying, it has been attributed to early trend followers. VectorVest is the epitome of “trend following,” and Dr. DiLiddo always believed in using a trading plan.

What is a trading plan? Well, Investopedia states that a trading plan “is a systematic method of identifying and trading securities. It considers several variables, including time, risk, and the investor’s objective. A trading plan outlines how a trader will find and execute trades, including under what conditions they’ll buy and sell securities, how large of a position they’ll take, how they’ll manage positions, and what securities can be traded.”

VectorVest has found that having a trading plan helps investors take the emotion out of investing and save time on decision making (because, with a trading plan, the decisions have already been made). All trading plans contain three vital parts: When to Buy, What to Buy and When to Sell.

When to Buy. Despite popular belief, there is a time we should be buying stocks and a time we should not be buying stocks. VectorVest provides unique and totally objective Market Timing Systems to help you answer this question no matter what type of investor you are. For example, an aggressive investor would use our fastest, most aggressive timing signal, the Primary Trend, as their signal for When to Buy. Whereas, a conservative investor would want to use the most conservative Market Timing System, the Confirmed Call, as their signal for When to Buy. Remember, when it’s not time to buy stocks, cash is a position.

What to Buy. VectorVest believes in buying safe, undervalued stocks that are rising in price. The VectorVest Stock Viewer, by default, sorts every stock in the database by VST-Vector so that the stocks with the best combination of Value, Safety and Timing rise to the top. So, for conservative investors, following a Confirmed Up signal, top VST stocks would be ideal. Aggressive investors may also buy high VST stocks, with an emphasis on buying stocks with Relative Value, RV, greater than 1.00.

When to Sell. Selling a stock must be a personal decision and VectorVest believes that this decision should be made before entering a position. VectorVest calculates a stop-loss level for every stock in the database, every day. When a stock’s Price falls below its Stop price, you will see the VectorVest rating move to a red Sell rating. You may use the Sell rating as guide or gospel, but no investor should ignore it.

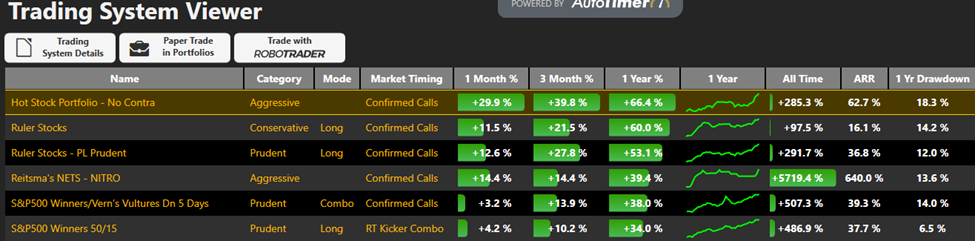

Over my nearly three decades with VectorVest, knowledge and technology have evolved and so has VectorVest’ s ability to offer our subscribers many ways to quickly and efficiently plan their trade and trade their plan. One such innovation is the Trading System Viewer (found under the Viewers tab).

The TSV contains over 50 trading systems which cater to all classes of investors and address When to Buy, What to Buy and When to Sell for each trading system displayed. You may choose to implement one of these trading systems as they are or use VectorVest tools to create your own. If you need help deciding which plan to use, head over to the “Special Presentation” where Mr. Ron Wheeler will show you the ins-and-outs of the TSV and help you choose one that’s best for you!

With the new year upon us, it’s never been easier to Plan Your Trade And Trade Your Plan.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment