Written by: Angela Akers

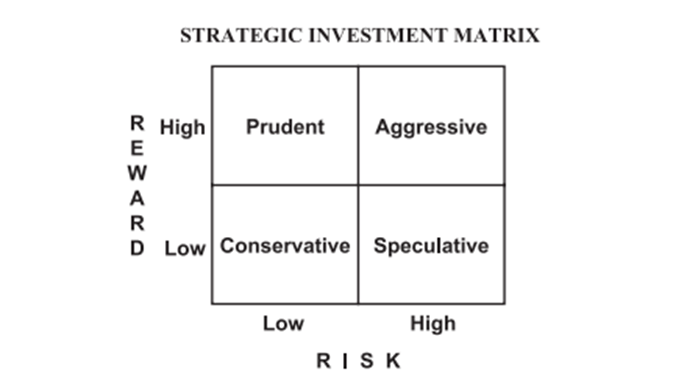

If you want to be a successful investor, you must know what your investment style is. If you want to be a successful investor that finds investing easy, you should buy stocks that are consistent with that style. As a reminder, the VectorVest Investment Matrix is talked about in great detail in Chapter 12 of Dr. DiLiddo’s infamous little green book, “Stocks, Strategies & Common Sense.” In essence though, the Matrix identifies the four basic investment styles, which are categorized by using two of our key proprietary fundamental indicators, Relative Value, RV, which measures the long-term price appreciation potential of a company and Relative Safety, RS, which is an indicator of risk and measures the consistency and predictability of a company’s financial performance. Both of these indicators are measured on a 0.00 – 2.00 scale with values above 1.00 being favorable and values below 1.00 being unfavorable.

If you’re not familiar with these indicators, here are some quick refreshers:

Last week, we discussed the Aggressive Investor. Focused on capital appreciation, they have a high risk, high reward approach to investing. The opposite approach to investing is the one we will focus on this week, the Conservative Investor.

Instead of capital appreciation, Conservative Investors are focused on capital preservation and generating regular cash flow. The conservative approach is one of low risk, low reward. Conservative Investors are almost certain to make money over the long-term, but typically do not experience blockbuster gains. I would describe it as the “steady as she goes” approach to investing.

The stocks that fall in line with the Conservative investment style are characterized in VectorVest by having a Relative Value, RV, below 1.00 and a Relative Safety, RS, above 1.00, ie. safe stocks with steady price performance. Because conservative investing is often associated with retirement investing, a safe and steady dividend is also important. Therefore, focusing on dividend paying stocks with a Dividend Safety, DS, rating of 50 or above is preferred.

Stocks that fit the Conservative style of investing are also very easy to find in VectorVest. Just click on the UniSearch tab of VV7 and select the Searches – Conservative group from the list on the lefthand side of the screen. You’ll find 7 Searches in this list that will help you find the best stocks to fit the Conservative investment style. And, of course, as with any investment style, you’ll only want to buy stocks when the market is rising. For Conservative Investors, the appropriate Market Timing system to use is VectorVest’s Confirmed Calls and they will buy stocks when the Confirmed Calls are in an Up mode.

Make sure you watch tonight’s “Special Presentation” where Mr. Jim Penna will explain more about the Conservative approach. And if you’re really serious about capital preservation, generating income and learning how to grow your account safely and securely, click here to sign up for our Retirement Portfolio Transformation course. Because we are invested in your success, for the first time ever, we are offering this course entirely FREE to all of our members. Trust me when I say, you do NOT want to miss it! Are You A Conservative Investor?

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment