Shares of Wayfair (W) fell more than 6% in pre-market trading early this morning, but have since rebounded. The stock now sits 5% higher than yesterday’s close.

This all came after the company delivered its third-quarter earnings. Wayfair reported dwindling sales as fewer and fewer customers shop with the online retailer.

Total net revenue of $2.94 billion narrowly missed the analyst expectation of $2.98 billion. This step back can be seen in the company’s falling active customers figure too – 22.3 million for the quarter represented a 1.3% drop from this time last year.

Wayfair ended up posting a loss for the quarter of 13 cents per share – which was ironically one of the only positive takeaways from the earnings report. Analysts were expecting a much larger loss for the quarter at 48 cents. The other good news is that orders delivered climbed nearly 14%.

Despite the downward trajectory that Wayfair’s financial performance showed in the quarter, management is still optimistic about the road ahead. CEO Niraj Shah pointed out that the company now has a positive adjusted EBITDA on a trailing 12-month basis.

Shah also referenced the tumultuous economic climate as a challenge, but he says the company still drove demonstrable market share growth. Wayfair is more committed to its profitability goals than ever before.

If today’s performance holds the stock will have climbed 9% in the past week. But, the big picture is concerning. W has dropped just about 40% in the past 3 months, and the negative performance in this quarter raises some red flags.

We’ve taken a look through the VectorVest stock analysis software and uncovered three things you need to know if you’re currently invested in W or considering trading this stock.

W Has Poor Safety With Very Poor Upside Potential and Timing - It’s Time to Sell!

VectorVest has outperformed the S&P 500 index by 10x over the past 20 years and counting. The system uses a simple proprietary stock-rating system to help you win more trades with less work and stress.

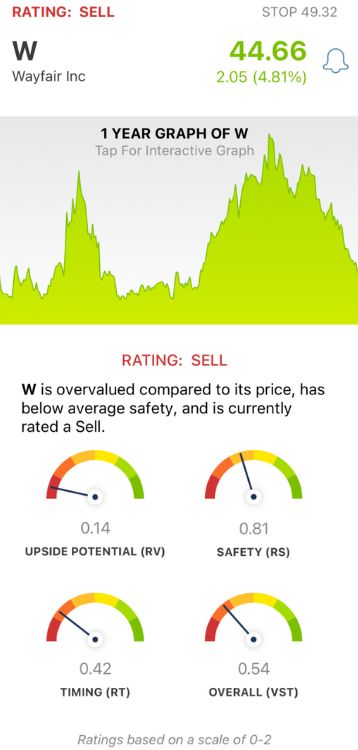

Investors can rely on 3 ratings for all the insights they need to make clear, confident decisions: relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on an easy-to-interpret scale of 0.00-2.00, with 1.00 being the average.

But, it gets even better. You’re presented with a clear buy, sell, or hold recommendation based on the overall VST rating for a given stock at any given time. As for W, here’s what we found:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted three years out) to AAA corporate bond rates and risk. This indicator offers far better insights than a simple comparison of price to value alone. As for W, the RV rating of 0.14 is very poor. The stock is overvalued, too, with a current value of just $5.29/share.

- Poor Safety: The RS rating is an indicator of risk. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, sales volume, price volatility, business longevity, and other factors. W has a poor RS rating of 0.81.

- Very Poor Timing: Despite a surprising bump in the right direction this morning, W still has very poor timing - as indicated by the RT rating of 0.42. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.54 is poor for W, and is enough to earn a SELL recommendation in the VectorVest system. Get a free stock analysis today and transform the way you trade for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. W saw declining sales and dwindling customer engagement in the third quarter, and yet, shares still popped 5% this morning. That being said, we dug deeper and saw that the stock has very poor upside potential, poor safety, and very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment