Walmart Inc. (WMT) is up more than 6% through this past week after delivering an impressive Q1 earnings performance coupled with an upbeat outlook for the full year.

America’s quintessential discount retailer grew revenue by 6% to $161.51 billion, surpassing the FactSet consensus of $159.57 billion.

The company saw a 21% uptick in e-commerce sales for the quarter which fueled this growth. Meanwhile, Sam’s Club sales increased by 4.6%, and international sales climbed by 12.1%.

On the profitability front, Walmart reported net income of $5.1 billion or 60 cents per share on an adjusted basis, outperforming the consensus call of 53 cents. This time last year the company delivered net income of just $1.67 billion, or 21 cents per share.

Chief executive Doug McMillon made it clear these results were not driven by inflation. Rather, general merchandise prices came down in the mid-single digit percentage range. This is a result of consumer spending remaining more focused on non-discretionary items.

One of the newest additions to the Walmart family, a private food brand called Bettergoods, helped drive this performance. It’s a timely introduction as more than 70% of the brand’s items are less than $5.

CFO John Rainey also made an interesting note on the company’s earnings call that Walmart is no longer stuck in the box of a “value” shopping experience. At least a third of its customer base brings in more than $100k a year.

The road ahead looks promising for the company as well, with a Q2 earnings forecast between 62 cents and 65 cents. The FactSet consensus is calling for 64 cents.

For the full year, Walmart is anticipating EPS at the high end or even above its original guidance of $2.23 to $2.37. With a consensus of $2.37, it’ll be interesting to see what the company can deliver.

In the meantime, WMT is up more than 22% through 2024 thus far, and the Q1 performance should help solidify this trend. So, is now a good time to buy WMT? We think so. Here are 3 more things we found through the VectorVest stock software…

WMT Has Good Upside Potential, Safety, and Timing

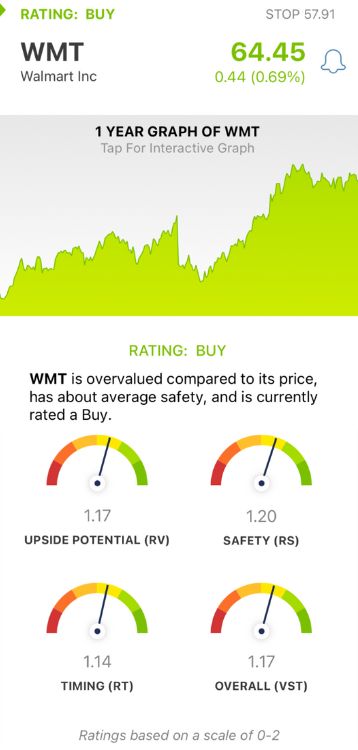

VectorVest is a proprietary stock rating system that gives you all the information you need to make emotionless, calculated decisions in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. This means you can win more trades with less work and stress. But it gets even better.

Based on the overall VST rating, you’re given a clear buy, sell, or hold recommendation for any given stock at any given time. As for WMT, here’s what you need to see:

- Good Upside Potential: The RV rating is a far superior indicator to the typical comparison of price to value alone as it compares the long-term price appreciation potential for a stock (forecasted 3 years out), AAA corporate bond rates, and risk. As for WMT, the RV rating of 1.17 is good.

- Good Safety: The RS rating is a risk indicator. It’s derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. WMT has a good RS rating of 1.20.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. WMT has a good RT rating of 1.14.

The overall VST rating of 1.17 is good for WMT and earns the stock a BUY recommendation. But before you make your next move, take a second to look deeper at this opportunity through a free stock analysis at VectorVest so you can trade with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. WMT delivered an impressive earnings beat on the top and bottom lines for Q1, and the discount retailer is anticipating solid performance for the current quarter and the remainder of the year. The stock itself has good upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment