Shares of U.S. Steel (X) have skyrocketed more than 30% so far in Monday morning’s trading session. The company just turned down a whopping $7.3 billion offer to acquire the company from Cleveland-Cliffs.

This deal would have had incredible implications for the steel industry as a whole – but for now, it’s business as usual for the country’s largest producer of flat-rolled steel in North America.

While the offer represented a 43% premium based on the price X closed at on Friday, the company’s board called it “unreasonable”. The biggest issue for U.S. Steel was that Cleveland Cliffs didn’t want to go through the customary process of assessing valuation and certainty.

What’s more, the deal would have drawn regulatory problems as the combined company would have controlled 100% of the U.S. iron ore market. And, automakers wouldn’t be too keen on the deal either – as it would have 50% of the market for exposed-quality automotive steel.

The deal was rejected with haste, and experts at KeyBanc Capital Market are highly skeptical that anything will change for these two parties. But that doesn’t mean the company won’t entertain other offers.

In fact, the company has been sent many unsolicited offers recently. They admitted they would be reviewing all of these as they explore strategic alternatives.

That being said, should you buy into the hype and add shares of X to your portfolio? The stock has gained more than 39% in the past 3 months now and nearly 20% YTD.

However, we’re going to help you tune out the noise and make your next move with complete confidence and clarity. We’ve assessed this opportunity through the VectorVest stock analysis software and have 3 things you need to see.

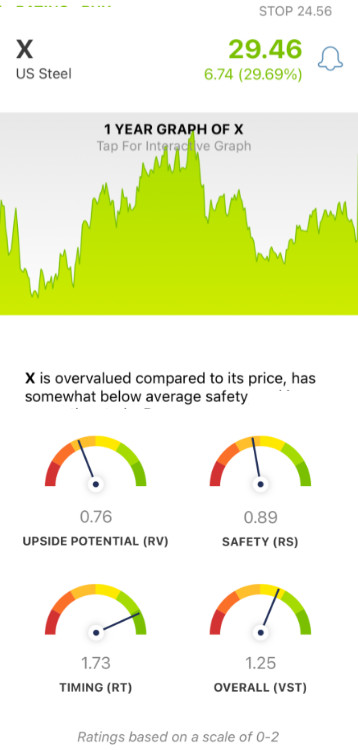

Despite Poor Upside Potential, X Has Fair Safety and Excellent Timing

The VectorVest system issues a clear buy, sell, or hold recommendation for any given stock, at any given time. This is all possible through a proprietary stock rating system that boils down everything you need to know into 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00, with 1.00 being the average for quick and easy interpretation. As for X, here’s what we found:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (projected 3 years out) to AAA corporate bond rates and risk. This offers far superior insights than a simple comparison of price to value alone. And right now, X has a poor RV rating of 0.76. The stock is considered overvalued with a current value of just $25.54.

- Fair Safety: The RS rating is an indicator of risk, and is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for X, the RS rating of 0.89 may be below the average but is deemed fair nonetheless.

- Excellent Timing: As you can see by looking at the stock’s price trend, X has excellent timing right now - with an RT rating of 1.73 to back it up. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.25 is very good for X…but is it enough to justify buying this stock yourself? Don’t play the guessing game or let emotion influence your decision-making. Get a clear buy, sell, or hold recommendation through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. After turning down a whopping $7.3b deal, X has excellent timing and fair safety - but poor upside potential.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment