Uber (UBER) reported first-quarter earnings alongside second-quarter guidance Wednesday that sent shares down 8%. To make matters worse, the company’s primary competitor, Lyft, delivered an earnings beat yesterday with optimistic guidance for the quarter ahead.

The first quarter saw a solid increase in revenue to $10.13 billion, a 15% gain year over year. This was just slightly ahead of the $10.11 billion consensus. Adjusted core profit came in at $1.38 billion while analysts were forecasting $1.32 billion. This was an 82% improvement YoY.

While the company delivered on both the top and bottom lines, performance was held back by the Uber Eats segment. It only grew 4%, well below expectations. Fortunately, an uptick in airport and office commutes lifted the business as a whole.

Uber has been working to improve profitability for a while, and it looks as if those efforts are starting to come to fruition. This will continue to reap benefits in the quarter to come as the company issued adjusted core profit guidance between $1.45 billion and $1.53 billion. Wall Street is expecting $1.47 billion.

However, the big takeaway from today was a disappointing Q2 forecast in gross bookings – and that’s what sent shares retreating. This is a key metric for assessing the total value of revenue earned on the Uber platform.

The range of $38.75 billion to $40.25 billion positions the company to fall short of the $40.04 billion forecast. This suggests Uber could be losing its footing in the race against Lyft, which has recently transformed its business by bringing in David Risher as CEO just a year ago.

UBER is still up 5% on the year after today’s step backward, but the trend over the past month is concerning. The stock has slid 14% in that time frame. So, where does that leave you as a current or prospective investor?

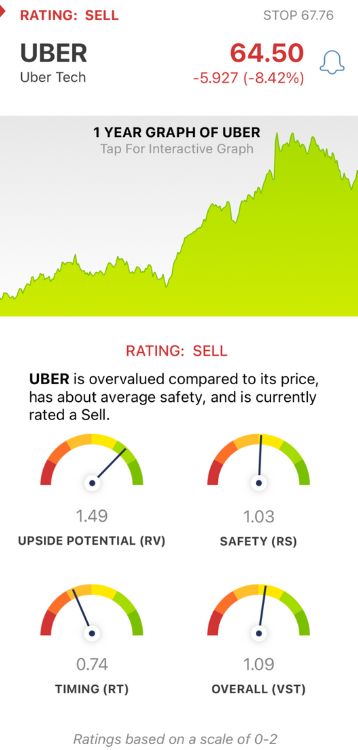

We took a look at this situation through the VectorVest stock analysis software and found a few reasons it may be time to cut losses on UBER.

UBER Still Has Excellent Upside Potential and Fair Safety, But Timing is Poor Right Now

VectorVest is an intuitive stock rating system that empowers you to win more trades with less work and stress. It delivers actionable insights in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average. This allows you to quickly and easily analyze opportunities and make more confident decisions. Better yet, you’re given a clear buy, sell, or hold recommendation based on the stock’s overall VST rating. Here’s what we see for UBER:

- Excellent Upside Potential: The RV rating is a far superior indicator than the typical comparison of price to value alone because it compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. UBER has an excellent RV rating of 1.49 right now.

- Fair Safety: The RS rating is a risk indicator. It’s calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. UBER is a fairly safe stock with an RS rating of 1.03.

- Poor Timing: The RT rating speaks to a stock’s price trend in both the short and long term. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. This is where UBER investors should be concerned, as the RT rating of 0.74 is poor, reflecting the stock’s performance recently.

The overall VST rating of 1.09 is still fair for UBER, but the stock is rated a SELL right now. Learn more about this situation before you make your next move with a free stock analysis at VectorVest - we’ll help you determine whether you should really cut losses or not!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. UBER fell today, adding to the losses over the past month, as the company issued weak guidance for the second quarter, losing ground on its competitor Lyft. The stock itself still has excellent upside potential and fair safety, but the timing is poor right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment