In the never-ending saga of Musk vs Twitter, it appears the eccentric billionaire is back with another proposal. This time? The original offer price of $54.20/share. Down below, we’ll highlight the details of what we know so far and what you should do from an investment standpoint.

This deal leads to a valuation of $44 billion for Twitter. Originally, Musk had agreed to this very same deal back in early 2022. He tried to pull out of the Twitter deal because of bots – or, so he claimed. We took a deep look at the issue and explained why – Twitter bots aside – the deal was a poor one looking purely at value, safety, and timing. As a result of all this, Twitter sued Musk to try and force his hand to go through with the deal. There’s been back and forth between the two parties since – until today.

While the two sides were scheduled to appear before a judge on October 17, it looks as if we may not get there. However, there is still much up in the air – as all these reports have come from close sources, and neither Musk nor Twitter has responded to comment on the matter.

Now – what does all of this mean for investors, such as yourself? Well, as of right now, your hands are tied – even if you wanted to trade TWTR stock. Most platforms have halted the trading of this particular stock as a result of all the calamity caused by Musk.

However, the news alone caused shares to soar almost 21% – to where they sit right now at $51.72/share. While the stock was still down over 20% in the past year, the company had been rebounding on its own before this deal. In the past 3 months before today, share prices had bounced up almost 12%. With the surge today, they’re up 35% over that three-month span.

With that said, the VectorVest stance hasn’t changed. Rather, it’s been solidified. When trading of TWTR is restored, here’s what you need to know…

Elon Musk Deal Aside, VectorVest Sees 2 Major Red Flags With TWTR Stock

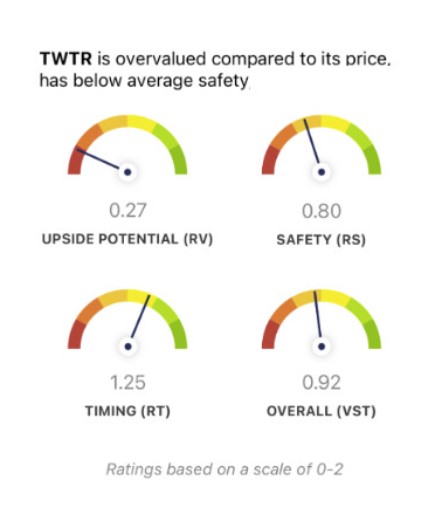

The VectorVest stock analysis tools simplify investing by telling you everything you need to know about a stock in three easy-to-understand ratings. These sit on a scale of 0.00-2.00 – with 1.00 being the average. Anything less is underperforming, anything greater is overperforming. The ratings are relative value (RV), relative safety (RS), and relative timing (RT).

Together, they make up the overall VST rating a stock is given. And from there, the system provides you with a clear buy, sell, or hold recommendation. This allows you to make trades in confidence – no guesswork, no emotion. With that said, this is what you need to know about Twitter from a trading standpoint:

- Very Poor Upside Potential: When we last discussed Twitter, the upside potential left much to be desired. And, despite Musk looking to reenter his original deal, the RV rating for Twitter has dropped even lower to 0.27. And while Musk is willing to buy the company at $54/share, VectorVest calculates its current value to be an abysmal $6.66/share.

- Poor Safety: Moreover, the RS rating of Twitter is poor at just 0.80. This is calculated from a deep analysis of the company’s financial consistency and predictability, business longevity, debt-to-equity ratio, and other risk factors.

- Very Good Timing: The one positive thing Twitter has going for it is the positive price trend that’s been forming over the past few months – which will certainly be solidified by today’s news. As a result, the RT rating of 1.25 is very good. This has been computed based on the direction, dynamics, and magnitude of Twitter’s price movement day-to-day, week-to-week, quarter-to-quarter, and beyond.

All of this works out to an overall VST rating of 0.92 – which is fair but below the average of 1.0. However, what exactly should your next move be? If you want a clear answer based on tried-and-true stock analysis, you can analyze any stock free here. You’re not going to want to trade Twitter stock until you’ve seen this…

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for TWTR, it is overvalued with very poor upside potential and poor safety. However, the very good timing it has right now may create an opportunity for investors when trading is restored – but you’ll need VectorVest’s help to determine the right entry and exit point.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment