Toast (TOST) released second-quarter earnings earlier this week in Tuesday’s after-hours trading session. Shares climbed more than 20% on the news before settling off a bit lower – but in Friday morning’s session, the stock picked back up and has gained more than 4% so far.

The company creates technology for the restaurant industry, like POS systems, payment processing, online ordering, and more. And for the first time in the company’s public history, it turned a positive free cash flow for the quarter.

The net loss of $98 million, or 19 cents/share, was a step backward from the same quarter last year where the company reported a loss of just $54 million, or 11 cents/share. But what has people excited is the free cash flow the company reported of $39 million.

This is the result of a relentless focus on driving lean, durable growth Chief Executive Chris Comparato says. While Toast is still in the early stages of the opportunity ahead of it, he remains more optimistic than ever about the company’s ability to penetrate the entire restaurant market.

Revenue for the quarter soared to $928 million from just $675 million the year prior. Analysts were projecting just $943 million. The company expects to deliver between $1.01-$1.04 billion in revenue for the quarter ahead compared to the FactSet consensus of $1 billion even.

After IPOing at over $65 in 2021, TOST has fallen around 64% to where it sits today. There is hope that after getting its footing for the past few years, the stock is now poised to reach the potential people initially saw in it. Is this your sign to buy, though?

Below, we’ve put TOST through the VectotVest stock forecasting software and found three things we want to share with you. Whether you’re currently invested in this stock or are considering trading it, you’re not going to want to miss this…

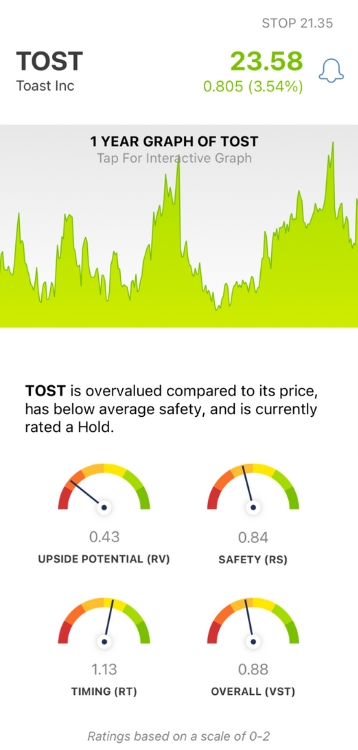

TOST Has Very Poor Upside Potential and Poor Safety, But the Timing is Good For This Stock Right Now

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on a simple scale of 0.00-2.00, with 1.00 being the average.

This makes interpretation quick and easy, saving you time and stress while empowering you to win more trades. But, it gets better. Because based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation - at any given time. Here’s what we uncovered for TOST:

- Very Poor Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (forecasted 3 years out) and AAA corporate bond rates & risk. Right now, TOST has a very poor RV rating of 0.43. The stock is overvalued at its current price, with a current value of just $2.56/share.

- Poor Safety: In terms of risk, TOST has poor safety - with an RS rating of 0.84. This is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Good Timing: The one thing TOST has going for it right now is good timing - with an RT rating of 1.13. This speaks to the trend behind the stock, as the rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.88 is a ways below the average but is still deemed fair nonetheless. That being said, is this stock worth buying now - or should you wait for further confirmation before getting in?

Don’t play the guessing game or let emotion influence your decision-making. A clear buy, sell, or hold recommendation is just a click away through a free stock analysis at VectorVest.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite a milestone earnings day that involved the company’s first time reporting positive free cash flow, TOST still has very poor upside potential and poor safety. However, the stock does have good timing right now as a result of this news.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment