Tesla (TSLA) delivered earnings for the third quarter yesterday, sending shares more than 10% lower in a single day and reaching its lowest point in more than 2 months. The stock continued that trajectory into Friday’s trading session and is down 5% so far this morning.

While revenue did climb 13% year over year for the quarter, the $23.4 billion reported still fell short of the $24.06 billion estimate. The real concern was in regard to profitability, though.

The electric vehicle manufacturer missed the analyst consensus for profits, reporting $2.3 billion in net income compared to the $2.56 billion expected. This resulted in a gross margin of 17.9% compared to the expected 18.2%. EPS of $0.66 was also a miss compared to the consensus of $0.74.

Tesla has been working to cut costs since late 2022 amid continuous downward pressure on margins. CEO Elon Musk himself has voiced concerns about the global economy and how it will affect his company.

That being said, the one positive takeaway was that Cybertruck deliveries are still on track to begin November 30. Musk is estimating 12-18 months before the new EV becomes cash flow positive. That being said, the goal is to deliver 250k units annually by 2025 – although Elon hinted at serious production challenges in getting to this goal.

Speaking of production volume, Tesla stood strong by their production goal of 1.8 million vehicles for the full year of 2023. The company has already delivered 1.3 million vehicles so far this year.

Elon Musk also referenced the efforts in regards to Giga Mexico as part of reaching production goals. The groundwork is underway but Musk is hesitant to go “full tilt” on the facility. He cited issues with rising interest rates getting in the way.

This news had analysts across the board cutting their price target. We wrote about Tesla’s Saudi factory efforts around this time last month, at which point the stock sat at $267/share. Today it sits at just $210/share.

So, is it time to sell TSLA and cut your losses? We’ve uncovered three things in the VectorVest stock analysis software to help you make your next move with complete confidence and clarity.

Despite Good Upside Potential and Excellent Safety, TSLA Has Poor Timing

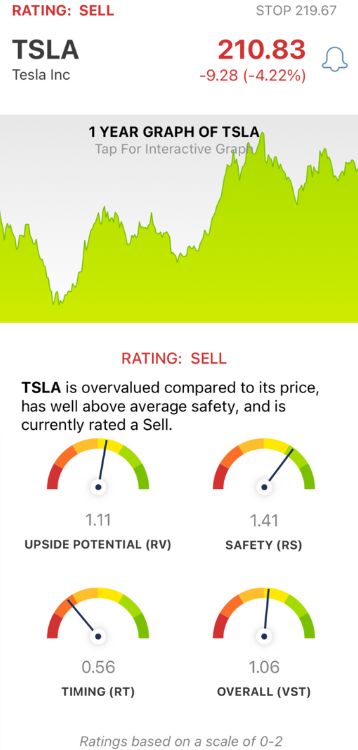

VectorVest simplifies your trading strategy by giving you all the insights you need to make calculated, emotionless investment decisions in three ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. But, it gets even easier - as the system issues a clear buy, sell, or hold recommendation for any given stock at any given time based on the overall VST rating. As for TSLA…

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. And right now, TSLA has a good RV rating of 1.11 - but it is overvalued. The stock’s current value is just $103.91.

- Excellent Safety: The RS rating is an indicator of risk. It’s derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. TSLA currently has an excellent RS rating of 1.41.

- Poor Timing: The biggest issue for TSLA right now is the poor RT rating of 0.56 - which reflects the stock’s abysmal performance over the past few weeks. The rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.06 is slightly above the average and considered fair, but VectorVest has issued a SELL warning for TSLA right now. Learn more about this stock and how the system works with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. TSLA is down 15% in the past week after delivering lackluster earnings and raising concerns regarding the road ahead. The stock has good upside potential and excellent safety, but poor timing is holding it back right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment