Target (TGT) has been battling serious backlash in recent weeks after shoppers took offense to their “tuck-friendly” swimsuits and a “the Devil Respects Pronouns” shirt. These products were designed for the transgender community and were part of a larger Pride line that hit shelves not too long ago.

Critics claimed that these products shouldn’t be sold to children – or even be on the shelves in the first place. While Target responded by saying the “tuck-friendly” feature wasn’t included in children’s lines, it wasn’t enough to dispel a boycott.

Figureheads like comedian Chrissie Mayr and broadcaster Tomi Lahren expressed their outrage and rallied the troops. This led to a dramatic drop in the past few weeks in TGT share prices. But, more seriously, it led to threats at Target retail centers, compromising the safety of employees.

As a result of this, Target made the decision to remove or relocate these items – as Pride month looms just over a month away. Now, there is a backlash on the other side of the coin. The LGBTQ+ community is up in arms, feeling abandoned and ostracized.

This is a classic situation of damned if you do, damned if you don’t. Bud Light faces a similar issue after a recent marketing decision to partner with trans activist and influencer Dylan Mulvaney.

While TGT stock had already been trending downward in the past few months, it dipped hard in the past week. The stock is down nearly 11% in that timeframe and is down another 2%+ today alone.

While this news will eventually pass once consumers find something else to be mad about, we dug a bit deeper into the TGT from purely a stock analysis standpoint. Through the VectorVest stock analyzing software, we’ve uncovered two other things investors or prospective traders need to see.

Controversy Aside, TGT Has Poor Upside Potential and Timing

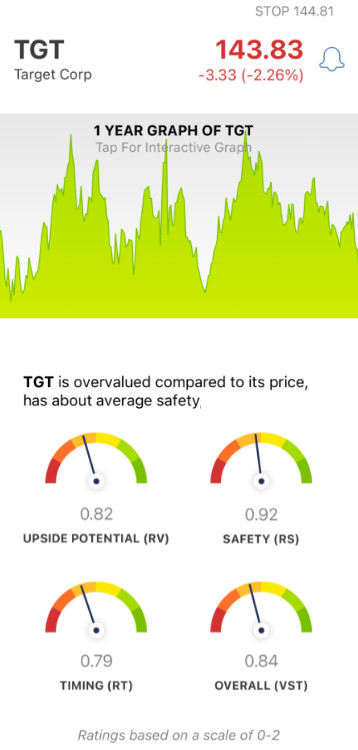

VectorVest helps you simplify your trading strategy by giving you all the information you need in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average.

So, you can win more trades with less work by simply picking stocks with ratings appreciating above the average as they rise in value. It’s that easy - but it gets even easier. Because based on the overall VST rating for a stock, the system provides a clear buy, sell, or hold recommendation. As for TGT, here’s what we’ve unearthed:

- Poor Upside Potential: The RV rating is derived through a comparison of a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. And right now, TGT has a poor RV rating of 0.82. Moreover, the stock is overvalued - with a current value of just $110.

- Fair Safety: In terms of risk, TGT is a fairly safe stock - but it’s worth noting that the RS rating of 0.92 is slightly below the average. This rating is calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: As you can see by pulling up a TGT chart today, the stock has poor timing - and this has been the case for a while. The RT rating of 0.79 is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

Controversy aside, TGT has some serious issues holding it back. As an investor, is this your sign to cut losses and sell your shares? Or, should you weather the storm and patiently ride it out? Don’t play the guessing game or make a decision rooted in emotion. Get a clear answer on your next move through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for TGT, it’s currently the center of controversy - but that’s not the only problem we see with this stock. While it’s still fairly safe, we’ve discovered that it has poor upside potential and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment