Shares of Starbucks (SBUX) were down roughly 4% yesterday during after-hours trading, but they’ve leveled off this morning since the market opened and are relatively flat on the day. This all comes after the company reported quarterly earnings that left much to be desired.

A profit of 80 cents per share was a massive disappointment as analysts were expecting a profit of $1.03 per share. Sales were lackluster as well. The coffee conglomerate brought in just $9.1 billion in revenue compared to the consensus of $9.38 billion.

Starbucks also announced that it wouldn’t be sharing its own internal forecast for a while as its new CEO, Brian Niccol, gets his bearings and finds his stride in the company.

Some experts are suggesting that SBUX should have fallen a lot more on news like this, but that the market may be showing patience and optimism for the new boss. The appointment of Niccol to CEO came back in August of this year and sent the stock 23% higher.

Niccol went on to say that it’s quite apparent the company needs to pivot its strategy to get back towards a state of growth. He referenced the “Back to Starbucks” plan as a great step in the right direction.

After successfully growing Taco Bell and Chipotle, it’s clear that Niccol has the skills and expertise to turn things around for Starbucks. He says that the issues holding the company back right now are well-known and should be relatively easy fixes.

Despite the disappointing performance in the quarter Starbucks still raised its dividend by 4 cents, up to 61 cents a share.

SBUX has stayed fairly steady since its surge in August, and the stock sits slightly less than 1% higher through the year thus far. So, is the stock poised to pop in the remainder of the year? Is now a good time to buy, or should you hold off?

We’ve analyzed SBUX for you in the VectorVest stock software and found 3 reasons you might consider buying this stock today. Here’s what you need to know…

SBUX Has Fair Upside Potential and Safety With Excellent Timing

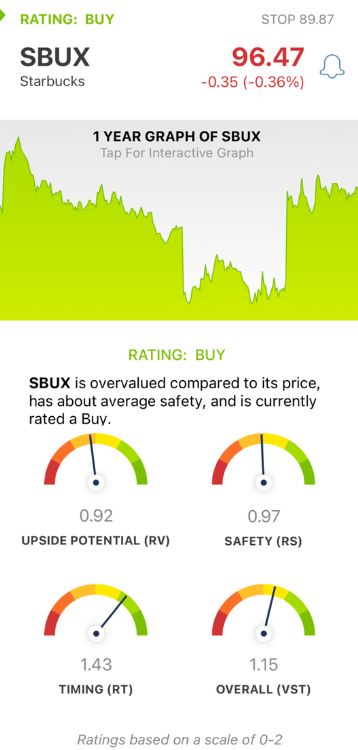

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it. The best part is you’re given all the insights you need to make calculated, emotionless investment decisions in 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation effortless.

You’re even given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for SBUX, here’s what we uncovered:

- Fair Upside Potential: The RV rating is a far superior indicator than the typical comparison of price to value alone because it compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. SBUX has a fair RV rating of 0.92, just below the average.

- Fair Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.97 is also fair for SBUX.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. This is where things get interesting, as SBUX has an excellent RT rating of 1.43

The overall VST rating of 1.15 is good for SBUX, and the stock is still rated a buy today even after a less-than-impressive quarterly earnings performance.

But whether you’re currently invested in this stock or waiting to trade it, there’s a bit more to this opportunity than meets the eye. Empower yourself to make the right move at the right time by taking a closer look at this free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SBUX moved lower yesterday on the heels of weak earnings, but the stock has recovered since. The market is staying patient with the company’s new CEO. The stock itself has fair upside potential and safety with excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment