As more and more companies dive into the world of AI and attempt to capitalize on the hype, Snowflake (SNOW) is the latest to receive a bump. The stock is up more than 13% in the past week, and is still climbing today – up nearly 2% in Tuesday’s trading session.

On Monday, Brad Reback of Stifel upgraded the stock – raising his price target dramatically from $145 to $185 and moving his position from “hold” to “buy.” Reback believes the stock could appreciate 16% within the next year. But what is he seeing that has him so excited?

While the company has battled tough headwinds over the past few quarters, he believes these have stabilized. His stance is that the company has weathered the storm and is on the other side – now poised for consistent revenue growth as high as 30%.

Moreover, Reback points to the increased focus on cost discipline within the company. This will lead to better margins, creating extra cash flow to invest in opportunities like AI. Speaking of which, the AI revolution is something Reback feels Snowflake is positioned to capitalize on.

The company’s business lies in helping other organizations gain greater insights from data through its cloud-based platform. In theory, the platform holds the data that companies building/training their AI engines need. As a result, Snowflake is sure to benefit from the global expansion into generative AI.

Reback isn’t alone in his hopefulness for Snowflake, either. S&P Global Market Intelligence polled 41 analysts, and 17 rated the stock a strong buy. Meanwhile, 10 more maintained a buy recommendation. 12 believe it’s still worth holding, while just 2 think it’s time to sell.

We’ve taken a detailed look at SNOW through our proprietary stock rating system – and we have a few things you need to see before you make your next move…

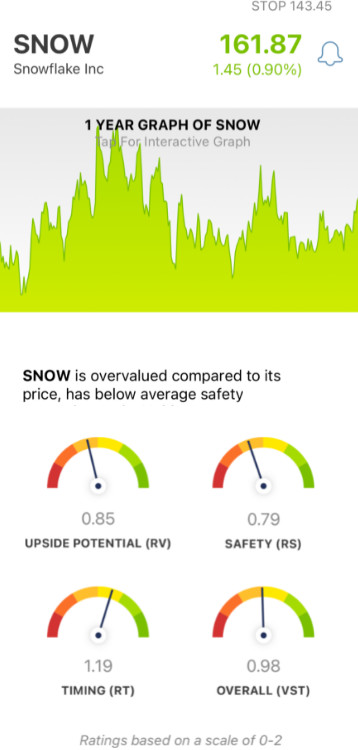

While SNOW Has Fair Upside Potential and Good Timing, Its Safety is Poor

The VectorVest system simplifies your trading strategy to help you win more trades with less work. You’re given all the insights you need to make confident, emotionless decisions through 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting these ratings is quick and easy, as each one sits on its own scale of 0.00-2.00. The average is 1.00, so it’s as simple as picking stocks with ratings appreciating above the average.

Or, better yet, follow the clear buy, sell, or hold recommendation VectorVest issues based on the overall VST rating for a stock. As for SNOW, here’s what you need to know…

- Fair Upside Potential: The RV rating is a comparison of a stock’s long term price appreciation potential (projected 3 years out) with AAA corporate bond rates and risk. As for SNOW, the RV rating of 0.85 is a ways below the average - but is still considered fair nonetheless. With that said, the stock is overvalued - with a current value of just $21.

- Poor Safety: The biggest issue for SNOW is poor safety - as reflected by the RS rating of 0.79. This is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Good Timing: The one thing this stock has going for it right now is momentum after Reback’s upgrade. With a 13% gain in the past few days, the stock has good timing - and the RT rating of 1.19 confirms that. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

All things considered, the overall VST rating of 0.98 is fair - just barely below the average. Is it enough to earn the stock a buy, though? Or, should you hold on a bit longer to see how the stock performs in the coming days or weeks? A clear answer awaits you - make your next move with complete confidence through a free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While Reback’s upgrade has resulted in good timing for SNOW, the stock’s upside potential is still just fair - and its safety is poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment