While Snapchat is set to declare 3rd quarter earnings this Thursday, investors and analysts alike are already preparing for the worst. In fact, one analyst out of Deutsche Bank has gone on the record saying he sees very limited upside potential in SNAP stock.

Benjamin Black was quoted as saying “We think near and medium term upside remains limited due to the impact macroeconomic uncertainties could have on ad spend, notably given the experimental nature of Snap’s ad platform, companies exposure to volatile categories such as crypto and apparel, and potentially dilutive engagement shifts.”

And, he’s not alone in this sentiment. Brian White of Monness Crespi Hardt echoes his thoughts – reporting that Snapchat is not only the worst-performing stock thus far in 2022, but that the worst of this company’s woes have yet to come to fruition.

Part of this is due to the limited upside potential the photo-sharing app has. In the company’s 2nd quarter earnings report, Snap Inc. claimed their underperformance was due to a drop in the digital advertising market as a whole – along with deep cost cuts internally for the company. Meanwhile, partial blame can also be attributed to the overall economic downturn our country is facing.

So – what can you expect from the upcoming earnings report in a few days? Analysts are predicting as high as a 24 cents/share loss – up from 5 cents/share this time in 2021. Meanwhile, revenue will basically fall flat year over year with no notable growth.

However, there is one bit of good news – one analyst, in particular, believes that the 4th quarter could be SNAPs best of the calendar year. While this isn’t saying a whole lot, there could be a temporary bump from the World Cup, midterm elections, and the holiday season in general. With that said, the challenges of poor macroeconomic conditions and growing advertising conditions remain for SNAP.

So – what should your next move be as an investor? Let’s take a look through VectorVest’s stock forecasting tools to help you uncover your next move with no emotion and no guesswork.

2 Major Red Flags for SNAP Stock That Investors Need to See…

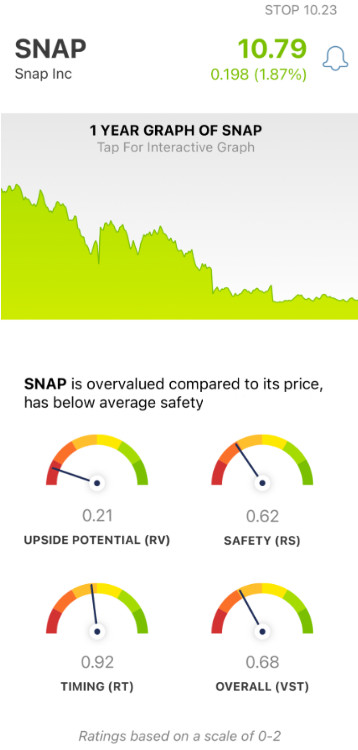

The VectorVest system simplifies trading by granting you clear, simple insights into stock analysis. It tells you all that you need to know about an opportunity based on three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 – with the higher end of that range indicating better performance, and vice versa.

Together, these three ratings make up the overall VST rating a stock is given – and deem whether it’s rated as a buy, sell, or hold at any given time. As for SNAP, there are a few major red flags you need to take note of before initiating your next move:

- Very Poor Upside Potential: The VectorVest system echoes what analysts have been saying – the upside potential for SNAP is very poor, with an RV rating of just 0.21. Moreover, the stock is overvalued at the current price of $10.79/share. VectorVest calculates the current value to be just $1.81.

- Poor Safety: The second red flag to take into account for SNAP is the poor RS rating of 0.62. This is calculated based on a deep analysis of the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: The one thing SNAP has going for it right now is the positive price trend that’s been forming over the past few days leading up to earnings. While the RT rating of 0.92 is just fair, it has been gravitating in the right direction. This rating looks at the dynamics, direction, and magnitude of a stock’s price movement day over day, week over week, quarter over quarter, and year over year. As the RT rating passes over 1.00 and continues moving in the right direction, it will help you confirm the trend.

All this considered, the overall VST rating for SNAP is poor at just 0.68. Does this mean it’s time for you to close your position and cut losses? Or, if you’re looking to get into SNAP stock ahead of earnings, is this the right time? To get a clear answer on your next move with SNAP and help you execute trades in confidence, analyze the stock free today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SNAP, it is overvalued with very poor upside potential and poor safety. While the timing still isn’t quite right, the price trend is moving in the right direction – but you should wait for confirmation of this trend before executing your trade. The VectorVest system can help you time your next move.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment