Shopify (SHOP) shares got a nice 22% boost in Thursday morning’s trading session after the company reported third-quarter earnings that beat expectations on both the top and bottom lines. The e-commerce platform also provided upbeat guidance for the remainder of the year.

Revenue of $1.71 billion outperformed the analyst expectation of $1.67 billion. This represented a 25% increase year over year, and 30% when adjusted for the 500 basis points impact provided by its logistics business.

Part of this growth can be attributed to an uptick in monthly recurring revenue, which was up 32% in the third quarter to $141 million. But, it’s fair to say that the recent Amazon partnership catapulted some level of growth as well.

Meanwhile, profitability improved for the quarter as well. The company posted a loss of $346 million this time last year. But this morning, Shopify proudly reported an operating income of $122 million.

Free cash flow also showed a dramatic turnaround year over year, $276 million this quarter compared to negative free cash flow of $148 million back in the third quarter of 2022. EPS of 24 cents per share on an adjusted basis was well above the consensus estimate of 14 cents.

Improvements in profitability can be traced back to the company’s cost-cutting measures. It laid off a chunk of its workforce, sold off its logistics unit, and sharpened its focus on simply empowering merchants around the world with the best e-commerce platform possible.

CFO Jeff Hoffmeister says that Shopify has a durable business model that will only get stronger as the company continues to invest in huge opportunities ahead across the various regions, products, and channels available.

Looking ahead, Shopify expects revenue for the full year to grow somewhere in the 25% range, as the fourth quarter is expected to provide impressive revenue growth itself.

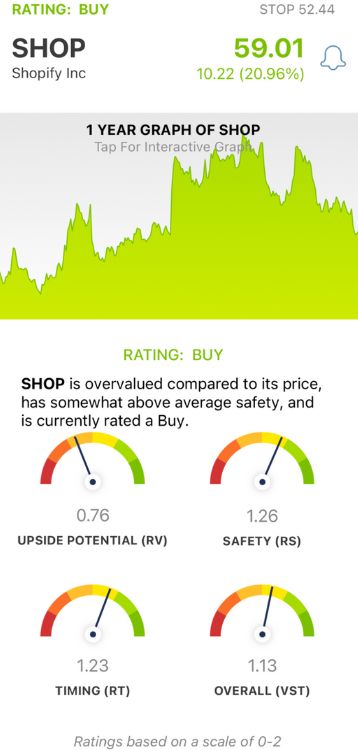

The stock is now up 71% in the last year and looks stronger than ever. We’ve taken a look at SHOP through the VectorVest stock forecasting software and discovered 3 reasons to consider buying. Here’s what you need to know…

SHOP May Have Poor Upside Potential, But the Stock Shows Very Good Safety and Good Timing

VectorVest simplifies your trading strategy through a proprietary stock rating system that gives you all the insights you need in 3 ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average.

This makes interpretation quick and easy, but it actually gets even easier. You’re given a clear buy, sell, or hold recommendation based on the overall VST rating of any given stock at any given time. As for SHOP, here’s what we uncovered:

- Poor Upside Potential: The RV rating compares a stock’s 3-year price appreciation potential to AAA corporate bond rates and risk, offering far superior insights than a simple comparison of price to value alone. SHOP has a poor RV rating of 0.76 right now.

- Very Good Safety: The RS rating is an indicator of risk. It’s computed from an analysis of a company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. SHOP has a very good RS rating of 1.26.

- Good Timing: SHOP has a strong positive price trend pushing the stock higher and higher, and the good RT rating of 1.23 reflects this performance. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.13 is deemed good, and earns the stock a BUY recommendation in the VectorVest system. Learn more about SHOP or how the system itself works by getting a stock analysis free today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SHOP gained 22% after outperforming analyst expectations on the top and bottom line while providing an upbeat outlook for the remainder of the year. The stock has poor upside potential, but very good safety and good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment