Amazon announced that it has reached an agreement for an enhanced collaboration with Shopify (SHOP) yesterday after the market closed. Shares rose in extended trading and they picked right back up this morning, as the stock has gained more than 9% so far in Thursday’s session.

Amazon and Shopify already had a partnership in place, but now, Amazon is launching the “Buy With Prime” app for Shopify merchants.

This integration will make it easier than before for merchants to offer Prime benefits to customers from their own online storefront. This includes free/fast delivery, returns, and more all managed through the Amazon fulfillment network. In essence, Shopify merchants will benefit and so will customers who order through a Shopify site.

The checkout process will remain on the merchant side with Shopify payment processing, leaving questions as to how Amazon benefits from this deal. Shopify merchants still own the customer under this arrangement, which is one of the biggest deterrents to brands selling products through Amazon – giving up access to valuable customer data.

But, Amazon will still gain data that it otherwise wouldn’t have access to through this agreement. Moreover, the company will be able to optimize its fulfillment capacity. But, some analysts feel that there is more at play here – something in the long term that Amazon will benefit from that we just aren’t seeing yet.

Whatever the case, the news of this enhanced partnership bolstered what was already a strong positive price trend for SHOP, which has now climbed more than 18% in the last week. The stock is up more than 104% in the last year, but will it ever regain the highs it reached during the pandemic?

While there is no denying the timing for this stock, we took a look at SHOP through the VectorVest stock forecasting software and found something troubling. If you’re a current investor or are considering trading this stock, keep reading below – you’re not going to want to miss this one.

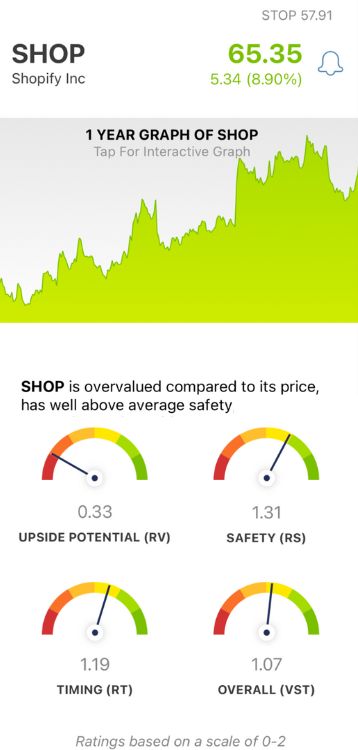

While SHOP Has Good Timing and Very Good Safety, the Stock’s Upside Potential is Very Poor

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on an easy-to-understand scale of 0.00-2.00, with 1.00 being the average.

But, it gets even easier - because based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation at any given time. As for SHOP, here’s what we found:

- Very Poor Upside Potential: the RV rating offers a comparison of a stock’s long-term price appreciation potential (forecasted three years ahead) to AAA corporate bond rates and risk. And right now, the RV rating of 0.33 is very poor for SHOP. Looking deeper, VectorVest considers the stock to be overvalued with a current value of just $6.13.

- Very Good Safety: In terms of risk, though, SHOP has very good safety with an RS rating of 1.31. This rating is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: As you can see by looking at the recent price movement for this stock, the timing is good - and the RT rating of 1.19 reflects that. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.07 is fair for SHOP, but what does that mean for investors or prospective traders? Does VectorVest consider this stock a buy, sell, or hold?

Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SHOP climbed higher as merchants will benefit from the arrangement with Amazon. That being said, the stock has good timing and very good safety - but very poor upside potential holding it back.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment