Shell Plc (SHEL) announced that it’s anticipating up to a $1.5 billion to $2 billion tax impairment for having to halt its Netherlands biofuels production facility. The divestment of its chemicals refinery in Singapore will play a part in the impairment as well.

The Netherlands site could generate as much as 820K metric tons of biofuels annually, much of which will be made from waste like cooking oil. The biofuels have applications in sustainable aviation fuel and renewable diesel fuel.

It was expected that production could start as soon as next year, but the company put out a release Tuesday saying it will need to put a pin in its construction efforts for the Rotterdam facility.

It’s facing fierce competition in the sustainable fuel market coming from the US and wants to be sure the project is set up for success in this landscape. The specific impairment figures for Q2 work out to:

- $600M to $1B for the Rotterdam Hub

- $600M to $800M for the Singapore Hub

Q2 results are set to be released on August 1, 2024. Shell also mentioned that its integrated gas segment isn’t going to bring in the profits that had been hoped for given seasonal fluctuations. However, the earnings for this segment in Q2 should still be fairly in line with 2023’s figures.

The company got more specific with its LNG production forecast as well, with an anticipated range of 940,000-980,000 boe/d for Q2 compared to the original outlook of 920,000-980,000 boe/d.

Quarterly LNG volumes should fall between 6.8M to 7.2M mt, which puts the company in line with last year’s performance at the high end and a step back from the first quarter of this year, which produced 7.6M mt.

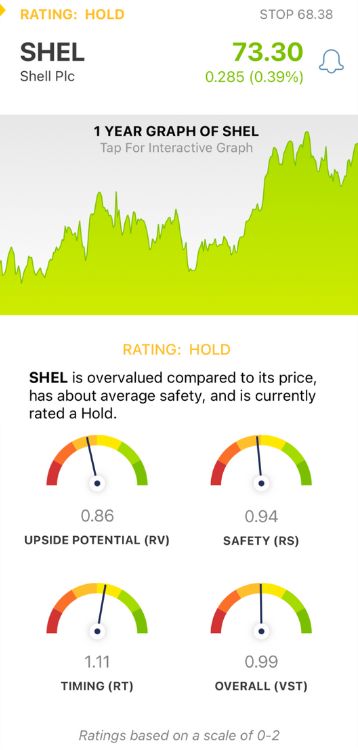

SHEL is up nearly 12% through 2024 thus far and rallied almost 5% over the past month as we approach Q2 earnings. Should you buy this stock before the results come out? We found 3 things in the VectorVest stock analysis software to help you decide one way or the other.

SHEL Has Fair Upside Potential and Safety With Good Timing

VectorVest is a proprietary stock rating system that simplifies your trading strategy to save you time and stress while helping you earn higher returns. It’s all based on 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating is placed on its own scale of 0.00-2.00 with 1.00 being the average. This makes analysis quick and easy - but it gets even better. The system issues a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for SHEL:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a far superior indicator than the typical comparison of price to value alone. SHEL has a fair RV rating of 0.86, albeit a ways below the average. The stock is overvalued with a current value of just $62.24.

- Fair Safety: The RS rating is a risk indicator that’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. SHEL has a fair RS rating of 0.94.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. SHEL has a good RT rating of 1.11 right now.

The overall VST rating of 0.99 is just below the average, but deemed fair nonetheless. SHEL is currently rated a HOLD in the VectorVest system, but take a moment to dig deeper with this free stock analysis so you can make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SHEL is forecasting a tax impairment as high as $2b after having to pause construction on its Singapore facility. The stock itself has fair upside potential and safety with good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment