As Pfizer’s sales continue to struggle, they’ve turned to acquisitions as a means of making up for lost revenue. And one company they have their eye on is Seagen – a cancer drugmaker with a market cap of roughly $30 billion.

Last year, Seagen was rumored to be acquired by Merck. This deal could have cost as much as $40 billion – but talks eventually fell through. Since then, Seagen shares have fallen 10%. But since the rumors of a potential landing spot at Pfizer have taken over, the stock has fully recovered and is up 11% today.

With that said, both sides have declined to comment on any potential deal – so this is all speculation at this point. However, in looking at the deal using common sense, it makes sense for both sides.

Pfizer is banking on a nearly $17 billion loss in annual revenue from 2025-2030. This can be attributed to a combination of patent expirations and a forgotten COVID-19 pandemic. Much of this company’s growth over the last 2 years is a result of vaccine sales causing a spike in revenue, and that segment has all but disappeared.

And, Pfizer has already made it clear that they intend to buy up smaller companies to make up the loss – with deals to acquire Global Blood Therapeutics, Biohaven, and now, potentially Seagen. The cancer drugmaker boasts approved therapies for lymphoma treatment and breast cancer. The company drove nearly $2 billion in annual revenue for 2022.

So, as an investor, does it make sense to pick up shares of Seagen in advance? While there’s no confirmation a deal will close anytime soon between the two parties, now could be a good time to get into SGEN – which has climbed over 43% in the past 3 months.

However, we see 1 major issue with this stock that you need to be aware of before making a decision. Here’s what we’ve uncovered through the VectorVest stock forecasting software…

Despite Excellent Timing, SGEN Has Very Poor Upside Potential

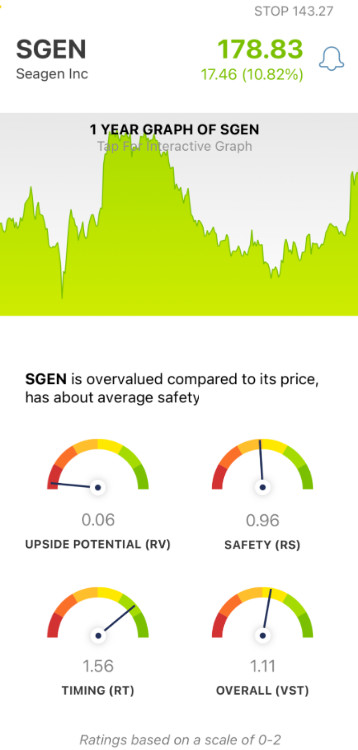

The VectorVest system simplifies your approach to trading by telling you everything you need to know about an opportunity in just three simple ratings - relative value (RV), relative safety (RS), and relative timing (RT). These are easy to interpret as they sit on a scale of 0.00-2.00, with 1.00 being the average.

But it gets even easier for investors - because VectorVest provides a clear buy, sell, or hold recommendation based on these ratings for any given stock at any given time - including SGEN. Here’s the current situation:

- Very Poor Upside Potential: In looking at the long-term price appreciation potential compared to AAA corporate bond rates and risk, VectorVest sees nothing for investors to be excited about. The RV rating of 0.06 is about as poor as it gets. Moreover, the stock is overvalued - with a current value of just $13.02/share.

- Fair Safety: An indicator of risk, relative safety assesses a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for SGEN, the RS rating of 0.96 is fair - just below the average.

- Excellent Timing: There’s no question - the timing is excellent for SGEN right now. The stock has had momentum in its sales for months now, and rumors of an acquisition will only solidify the trend we’ve witnessed. This is backed up by an excellent RT rating of 1.56, which is calculated by a deep analysis of the direction, dynamics, and magnitude of a stock’s price trend. It’s taken day over day, week over week, quarter over quarter, and year over year.

All things considered, SGEN has a good overall VST rating of 1.11. But is it enough to earn a buy? Does the excellent upside potential outweigh the abysmal price appreciation potential for this stock - or is it the other way around? Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks, and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell, or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, SGEN has very poor upside potential - but it does have fair safety and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment