Sarepta Therapeutics (SRPT) announced late Thursday it had gained FDA approval for its treatment designed to target a rare genetic disease known as Duchenne muscular dystrophy (DMD).

This condition causes progressive weakness, predominantly in boys, and is caused by a lack of key protein dystrophin. It has no known cure at this time. The typical protocol includes physical therapy and corticosteroids – which seek mainly to improve quality of life for as long as possible.

However, Sarepta is excited to lead the charge and potentially transform the way DMD is treated with ELEVIDYS (delandistrogene moxeparvovec-rokl), the name of its drug.

It’s approved to treat patients above the age of 4 no matter their ability to walk around. This means those just diagnosed and those who have been crippled by the disease alike have reason to hold onto hope that they can get better.

Dr. Jerry Mendell, the co-inventor of the drug and the company’s senior advisor of medical affairs, says that what makes this treatment so special is its ability to deliver gene therapy directly to the muscle.

Dr. Mendell went on to express his confidence in ELEVIDYS, saying that the FDA approval speaks to the level of science and evidence for improvements in treating the disease.

There’s just one catch – a single treatment for the drug is going to cost patients as much as $3.2 million. It will be interesting to see how effective Sarepta is in marketing the drug and getting healthcare providers and patients to take a chance on such an expensive therapy.

In the meantime, though, this is yet another win for the drugmaker in 2024. The company recently outperformed analyst expectations in its Q1 results, delivering revenue 10% higher and posting a profit of $0.37 earnings per share. Experts were anticipating a loss of 11 cents.

We’ve taken a closer look at SRPT through the VectorVest stock forecasting software, too. We found a few reasons you may want to consider buying this stock today.

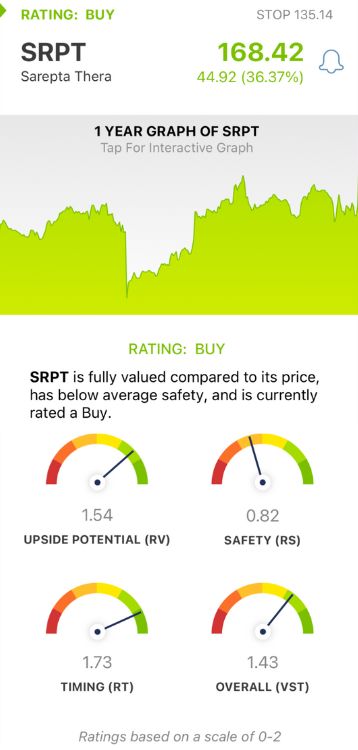

SRPT Has Excellent Upside Potential and Timing Despite Poor Safety, Earning the Stock a BUY

VectorVest is a proprietary stock rating system that takes complex financial data and technical indicators and distills them into simple, intuitive ratings that allow you to win more trades with less time and stress. These ratings are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even easier, though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for SRPT:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a far superior indicator than the typical comparison of price to value alone. SRPT has an excellent RV rating of 1.54.

- Poor Safety: The RS rating assesses a stock’s risk profile, taking into account financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. SRPT has a poor RS rating of 0.82 right now.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. SRPT has an excellent RT rating of 1.73.

The overall VST rating of 1.43 is excellent for SRPT and enough to earn the stock a BUY recommendation in the VectorVest system.

But before you do anything else, look over this free stock analysis so you can make a calculated, emotionless decision and set yourself up for a profitable trade. It’s time to transform your trading strategy with VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SRPT jumped 36% on the heels of its ELEVIDYS drug gaining full FDA approval, posing an exciting breakthrough in treating DMD. The stock itself has excellent upside potential and timing, despite poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment