Budget airline Ryanair (RYAAY) reported fiscal first-quarter results Monday morning that have the stock descending lower, continuing the concerning trend investors have been weathering over the past few months.

The company is struggling with profitability as fares continue to come down. After-tax profits of 360 million euros ($392 million) represented a 46% dip year over year when compared to 663 million euros back in 2023.

Part of the problem was that the Easter holiday which would typically give airlines a lift fell into the previous quarter. But the big issue – one that doesn’t appear to be going away anytime soon – is lower fares.

Despite posting a 10% increase in passenger traffic (up to 55.5 million) for the quarter, pricing is softening more and more. CEO Michael O’Leary said he expects the same for the current quarter. The previous expectation was for fares to remain flat or slightly up, but now, a dip is anticipated.

There were bright spots for the first quarter, though. The airliner is in the midst of its largest summer in company history with more than 200 additional routes and 5 new bases.

But if these don’t contribute to the bottom line, stock prices will continue to come down in correlation with the company’s profits. The company declined to give any guidance on Q3 and Q4, or the rest of the year as a whole.

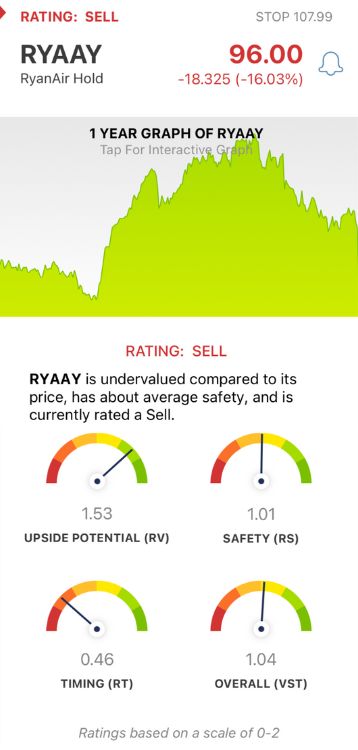

RYAAY has now fallen nearly 32% in the past 3 months. Is this your sign to sell? We think so after reviewing a few key metrics through the VectorVest stock analysis software. Here’s what you need to see before you do anything else…

RYAAY May Have Excellent Upside Potential and Fair Safety, But Timing is Very Poor

VectorVest helps you save time and stress in your stock analysis efforts while empowering you to earn higher returns. It does this by delivering clear, actionable insights in 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even better, though.

You’re given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. This eliminates human error, guesswork, and emotion from your decision-making. Here’s what we found for RYAAY:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This makes it a far superior indicator to the typical comparison of price to value alone. RYAAY has an excellent RV rating of 1.53.

- Fair Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.01 is fair for RYAAY.

- Very Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.46 is very poor for RYAAY, reflecting its performance in both the short and long term.

The overall VST rating of 1.04 is fair for RYAAY, but the stock is rated a SELL as it continues its downward trajectory. It’s time to cut losses if you haven’t already, but before you do, take a moment to dig deeper with this free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. RYAAY reported a concerning trend in its fare prices for the first quarter and the current quarter, which is taking a toll on profits. The stock itself may have excellent upside potential and fair safety, but very poor timing makes it a SELL.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment