Rumble Inc. (RUM) disclosed its second-quarter earnings results sending shares 5% higher so far Tuesday morning. The video-sharing and cloud services provider has sought to democratize the internet, and users are getting on board.

Revenue was up 27% from the first quarter to $22.5 million, but slightly down year over year. The company reported $25 million in revenue in 2023. The company ended the June 30 quarter with a balance of $154.2 million in cash and cash equivalents.

Rumble has begun using a new metric to assess its monetization efforts, known as “average revenue per user”, or ARPU. It will replace average minutes watched per month and hours of video uploaded per day as it better reflects the company’s performance.

ARPU saw a 19% increase quarter over quarter to $0.37. This growth was a result of higher sponsorship revenue. Speaking of users, average global monthly active users (MAUs) was up year over year and quarter over quarter. Rumble saw 53 million MAUs in Q2 compared to 50 million in Q1 and just 40 million this time last year.

As the presidential election heats up, the company also reported a new record for concurrent livestream viewers. The platform hosted 718,909 simultaneous viewers during the debate between Joe Biden and Donald Trump.

There’s a lot to be excited about as a Rumble investor, as the platform has announced partnerships with the Miami Dolphins and Hard Rock Stadium. The Rumble App is coming to Xbox, too, providing viewers with a new way to watch.

Rumble management also sees upside through the remainder of the year given its ability to capitalize on political advertising. The belief is that revenue will continue to climb in each subsequent quarter. The goal is to achieve adjusted EBITDA breakeven in 2025 as monetization efforts have been promising early on.

In the meantime, RUM has gained 34% so far through 2024 despite a hiccup over the past 3 months, in which the stock has fallen 10%. So, where does this leave you as a current or prospective investor?

We’ve taken a closer look at this opportunity through the VectorVest stock analysis software and have 3 things you need to see before doing anything else.

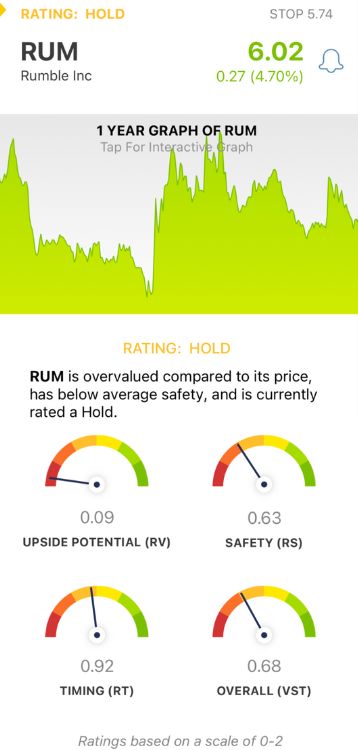

RUM Has Fair Timing, But Very Poor Upside Potential and Poor Safety Are Weighing it Down

VectorVest saves you time and stress by showing you what to buy, when to buy it, and when to sell it through a proprietary stock rating system that distills complex technical and fundamental data into clear, actionable insights.

You’re given everything you need to know in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average for quick and easy interpretation.

The system even gives you a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for RUM, here’s what you need to know:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. RUM has a very poor RV rating of 0.09 right now.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. RUM has a poor RS rating of 0.63.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.92 is just fair for RUM.

The overall VST rating of 0.68 is poor for RUM, and the stock is currently rated a HOLD. But, we encourage you to take a moment and look over this free stock analysis for deeper insights so that when the time comes you can capitalize on this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. RUM continues to ramp up its users and is now growing revenue through user monetization efforts alongside advertising revenue. The future looks promising, but for now, the stock has just fair timing with poor safety and very poor upside potential.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment