Rivian (RIVN) announced that it has been forced to pause production of the electric vehicle fleet it manufactures for Amazon as it’s having supply chain challenges. Shares have fallen 8% in the last week on the news.

This has been an ongoing issue since the start of the month as the company’s Normal, Illinois facility has not been able to work at full production capacity. However, all employees affected by the work stoppage still have the ability to work a full 40 hours.

While the company is keeping the specific part confidential and has declined to share a timeline on when production will be restored, a spokesperson did say Rivian will be able to catch up.

The spokesperson also did their best to quell investor concerns and turn down the heat, saying that part outages like these are not uncommon in the automotive industry, specifically the EV segment.

It’s worth noting that the issue is limited to Amazon’s delivery vans, and the company’s R1 electric pickup truck and SUV models are still being manufactured as planned.

Still, this is yet another bump in the road from a production perspective for Rivian. Given Amazon is the company’s biggest shareholder, this is something the company is working relentlessly to address.

Of the original deal to supply 100,000 EV delivery vans to Amazon, 15,000 are currently already being used – and there are even more waiting to be delivered.

Amazon’s own spokesperson chimed in on the issue saying the eCommerce company would be unaffected, as the Rivian fleet makes up just a small percentage of its total fleet.

This supply chain update comes on the heels of Rivian reiterating its full-year EV production goal of 57,000 vehicles. This falls in line with the figures from 2023, but it’s unknown at this time if this parts shortage will have an effect.

In the meantime, RIVN has fallen 23% in the past month alone. Despite the impressive rally we saw the stock form from mid-May to mid-July, it’s down more than 37% through 2024 thus far.

Just last month we wrote about Rivian getting a massive investment from Volkswagon. At the time, the stock was rated a buy. But is it time to sell today? We’ve taken a look at the VectorVest stock software to help you find out.

RIVN Has Poor Upside Potential and Safety With Fair Timing

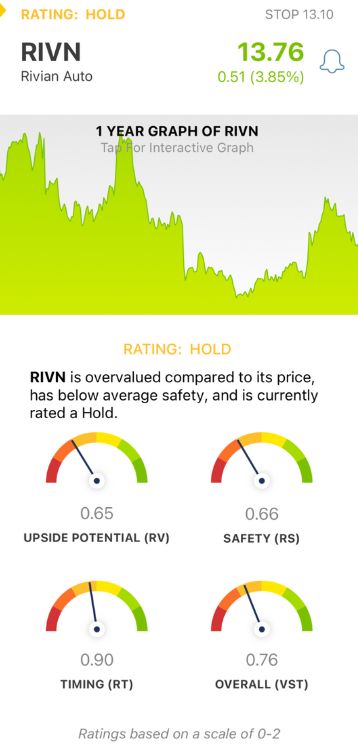

VectorVest simplifies your trading strategy by delivering clear, actionable insights in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

Better yet, you’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for RIVN:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. RIVN has a poor RV rating of 0.65.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. RIVN has a poor RS rating of 0.66.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. RIVN has a fair RT rating of 0.90, albeit a ways below the average.

The overall VST rating of 0.76 is poor for RIVN, but VectorVest still recommends holding this stock and weathering the storm.

There’s more to the story, though. If you want to learn a bit more about this situation and make the most informed investment decision, take a moment to assess this free stock analysis. Save time and stress while winning more trades with VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. RIVN is down 8% Friday morning, adding to the losses over the past month as the company’s part shortage could be affecting its relationship with key stakeholder Amazon. The stock itself has poor upside potential and safety with fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment