Recursion Pharmaceuticals (RXRX) just got an endorsement from one of Wall Street’s hottest stocks at the moment, and as such, has earned the attention of analysts, retail investors, and professionals alike. After securing a $50 million investment from Nvidia (NVDA), the RXRX shot up more than 76%.

The two companies are more alike than many realize. While one focuses on chip-making and the other is in pharma, they both have jumped aboard the AI train. Recursion uses machine learning to unearth revolutionary new medicines – which piqued the attention of Nvidia for obvious reasons.

After this investment, Recursion is being considered the obvious front-runner in the AI-driven biotech industry. With direct access to the most powerful AI computing company on earth, there’s reason to believe in the long-term potential for this stock.

But, Recursion isn’t the only company leveraging AI to identify new drug technologies. Its peers, Exscientia Plc, AbCellera Biologics, Relay Therapeutics, and Schrodinger Inc. all climbed on the news.

That being said, this deal came at a critical time for RXRX, as the stock had struggled for a while now. Just a few months ago in May, the stock reached its all-time low of $4.56/share. But, the surge is on – and there’s reason to believe the trend we witnessed from last week will continue.

So, should you follow Nvidia’s lead and buy RXRX yourself? Or, if you’re currently invested, is this your sign to take profits and run after the 76% gain last week? We’ve dissected this stock ourselves using the VectorVest stock analyzer, and we’ve got 3 things you should see before making a decision one way or the other…

While the Timing is Excellent for RXRX, it Has Poor Safety and Very Poor Upside Potential

The VectorVest system has outperformed the S&P 500 by more than 10x over the past 20 years and counting. What’s really impressive, though, is that it empowers you to do the same with less work and stress.

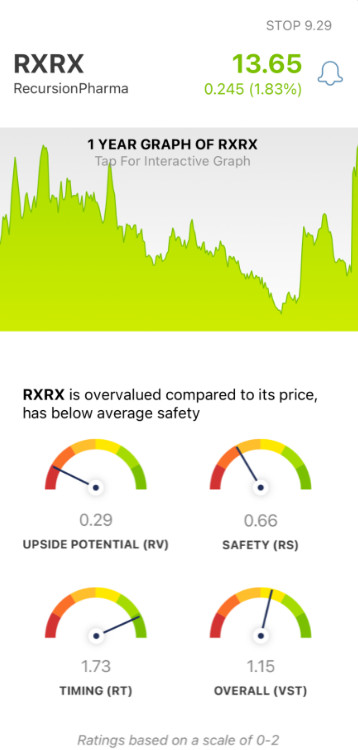

You’re given all the insights you need to make clear, calculated investing decisions through 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00, with 1.00 being the average.

But, it gets even easier, as based on the overall VST rating for a stock, the system offers a clear buy, sell, or hold recommendation - at any given time! As for RXRX, here’s what we’ve uncovered:

- Very Poor Upside Potential: The long-term price appreciation potential is very poor for RXRX, with an RV rating of just 0.29. This rating is derived through a comparison of the stock’s 3-year price forecast to AAA corporate bond rates and risk. That being said, we also found the stock to be overvalued - with a current value of just $1.94/share.

- Poor Safety: In terms of risk, RXRX has poor safety too - with an RS rating of 0.66. This rating is calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: Where things get interesting is in looking at the excellent RT rating of 1.73 for RXRX. This rating is derived from the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.15 is considered good for RXRX. But is it enough to justify a buy? Does excellent timing outweigh poor safety and very poor upside potential, or is it the other way around?

Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move and execute it with confidence using a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While AUDC has good timing and fair safety (albeit below the average), the poor upside potential is currently holding it back.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment