Shares of Radcom Ltd. (RDCM) climbed nearly 15% last week, and while we’ve seen a slight reversal after the weekend, the stock is still up more than 5% in the past 7 days.

This comes after the company noted that it saw an uptick in demand for a wide array of product offerings. Its cloud-powered automated assurance and intelligence analytics solutions, which live under the RADCOM ACE product line, are becoming more and more sought after.

We can see this in the most recent earnings performance for the second quarter of 2024. Radcom delivered a 20% increase in revenue, up to $14.8 million. Profitability is soaring, too, with a 170% increase in non-GAAP profits year over year thanks to efforts in cost reduction.

But, Radcom has no intentions of slowing down. It’s partnered with a number of distributors and local agencies in South America and Europe to grow its network.

The company also announced its mission to bring the power of AI to its product portfolio, including an integration with Amazon Web Services.

Looking at the current quarter, Radcom is anticipating earnings per share of $0.19, which would be another impressive year-over-year improvement of nearly 27%. Revenue growth is forecasted for 13.6%, which should work out to around $15 million.

The company has already closed more than $50 million in contracts through 2024 thus far. While most of this revenue won’t be realized until next year, it shows the company’s suite of solutions is becoming more in demand.

The 5G rollout is forcing network operators to look at new avenues to bring costs down, and the types of next-gen cloud technology Radcom offers are a perfect fit.

RDCM has gained just shy of 27% year-to-date. Although the stock’s correction today is not the start to the week investors had hoped for, things are looking up. So, should you buy this stock if you haven’t already, or bolster an existing position in RDCM?

Before you do anything else, take a moment to review what we found for RDCM in the VectorVest stock analysis software below.

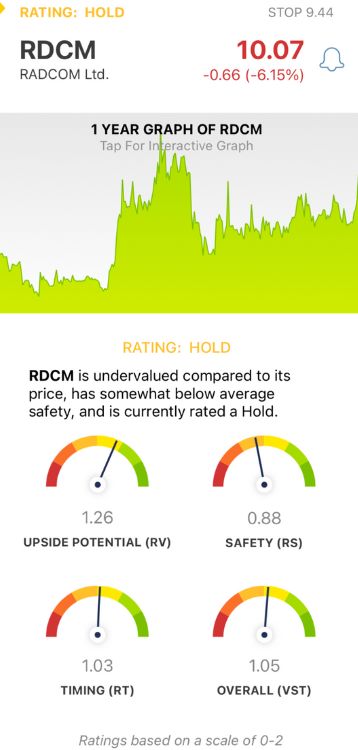

RDCM Has Very Good Upside Potential With Fair Safety and Timing

VectorVest is a proprietary stock rating system that distills complex technical indicators and fundamental data into clear, actionable insights. It saves you time and stress while empowering you to win more trades.

You’re given everything you need to make calculated, emotionless decisions in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

It gets even better, though. VectorVest provides a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for RDCM:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This makes it a far superior indicator than the typical comparison of price to value alone. RDCM has a very good RV rating of 1.26. Furthermore, the stock is undervalued with a current value of $17.48/share.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. RDCM has a fair RS rating of 0.88, albeit a ways below the average.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. RDCM has a fair RT rating of 1.03.

The overall VST rating of 1.05 is fair for RDCM, but not enough to earn the stock a buy rating. It’s currently a HOLD in the VectorVest system.

But, there’s more to this story than meets the eye - so take a moment to review this free stock analysis for RDCM and make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. RDCM may be down 6% Monday morning, but this is a minor correction after an impressive performance last week. The company’s offerings are more in demand than ever, and the future looks bright. The stock itself has very good upside potential with fair safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment