Peloton (PTON) is continuing its fall from grace with another day of plummeting share prices, down more than 23% in Thursday’s trading session. This comes after the fitness company delivered lackluster Q2 earnings alongside a weak outlook for the road ahead.

In what was supposed to be Peloton’s strongest quarter amidst the holiday season, Peloton posted revenue of $743.6 million, beating the analyst consensus of $733.5 million. Sales dwindled to just $743.6 million, down from $792.7 million this time last year.

However, the company posted a slightly wider loss than expected with a loss of 54 cents per share compared to 53 cents per share. The net loss for the fiscal second quarter was $194.9 million – which sounds bad but was quite an improvement year over year. Peloton posted a loss of $335.4 million previously.

This mixed bag for Q2 earnings was followed up by a less-than-optimistic guidance for Q3. The company is forecasting sales well below the Wall Street estimate of $754 million with a range of $700 million and $725 million.

Peloton is also expecting to lose between $20 million and $30 million on an adjusted EBITDA basis, while Wall Street is expecting a loss of only $2 million.

CFO Liz Coddington says this lackluster outlook is due in large part to uncertainty surrounding the success of key initiatives – from growing paid app subscribership to the TikTok deal we discussed earlier this month.

Meanwhile, new CEO Barry McCarthy is already in the hot seat after taking the helm less than 2 years ago. McCarthy set out with a goal of returning the company to growth within a year this time last year – and the company is clearly not in a state of growth yet. His goal of reaching sustained positive adjusted EBITDA in the same timeframe has also failed to come to fruition.

While there are some things to be excited about for PTON investors, like the success in retail partnerships and a strong rental bike program, there is more to be concerned about. The stock has plunged nearly 70% in the past year with no end in sight.

So, is it time to sell PTON? We think so after taking a look through the VectorVest stock software. Here are 3 things you need to see…

PTON Has Very Poor Upside Potential and Timing With Poor Safety to Boot

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past two decades and counting, empowering investors to win more trades with less work and stress.

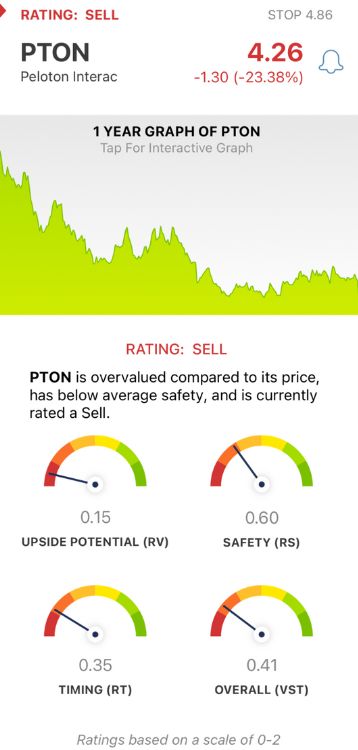

It’s all based on 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy - but it gets even better.

You’re given a clear buy, sell, or hold recommendation for any given stock based on its overall VST rating at any given time. As for PTON, here’s what we uncovered:

- Very Poor Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers way better insight than a simple comparison of price to value alone. The RV rating of 0.15 is very poor for PTON right now. The stock is overvalued even at this low price, with a current value of just $0.50.

- Poor Safety: The RS rating is a risk indicator derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.60 is poor for PTON.

- Very Poor Timing: This trend indicator is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. As the stock continues its downward trajectory in both the short and long term, PTON has very poor timing - with an RT rating of 0.35.

The overall VST rating of 0.41 is very poor for PTON, and VectorVest says it’s time to cut losses and sell this stock if you haven’t done so already. Learn more about the current situation through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PTON continues its path towards the bottom, losing another 24% today after a weak Q2 performance and cautious guidance for the current quarter. The stock has very poor upside potential and timing with poor safety as well.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment