After multiple quarters of stagnant or backward revenue growth, Peloton Interactive Inc. (PTON) finally saw sales climb higher year over year – no matter how marginally.

Revenue for the fiscal fourth quarter came in at $644 million, a modest 0.2% bump YoY and well ahead of the $628 million analysts were looking for. This was the first quarter of growth in more than two years.

Still, profitability concerns loom large as the company took a net loss of $30.5 million, which worked out to 8 cents a share. This did surpass the analyst consensus of a 17-cent loss, though. It was also an improvement from this time last year when the company faced a much wider loss at $241.8 million or 68 cents per share.

The good news was short-lived, however. The exercise equipment manufacturer is already preparing for revenue to fall once again for the fiscal first quarter. The current revenue guidance sits at $560 million to $580 million compared to $596 million in the previous period. Analysts are looking for at least $598 million.

The company did its best to keep investors and the broader market as a whole focused on the wins, no matter how small they were. Peloton executives said that the increased focus on aligning costs with business size is paying off from a profitability perspective.

With $26 million in free cash flow after the quarter, Peloton has some room to invest in further improvements as well. The shareholder letter stated that the company is trying to figure out how best to deploy that cash in accordance with its overall capital allocation strategy.

There are a few things to be excited about, though, for PTON investors. The company’s Bike+ rental model is gaining traction, while it’s seeing a surge in paid connected fitness subscriber additions as well.

PTON is up 5% so far today on the news, adding to the massive 51% rally its been on in the past week. The stock is still down more than 22% through 2024, but it’s clear the road to recovery is underway.

So, where does that leave you – is now a good time to buy PTON? We’ve taken a look through the VectorVest stock software and found a few things you need to see to guide your decision.

PTON Still Has Very Poor Upside Potential and Poor Safety With Excellent Timing

VectorVest is a proprietary stock rating system that saves you time and stress while empowering you to win more trades. It gives you all the insight you need to make calculated, emotionless investment decisions in 3 simple ratings.

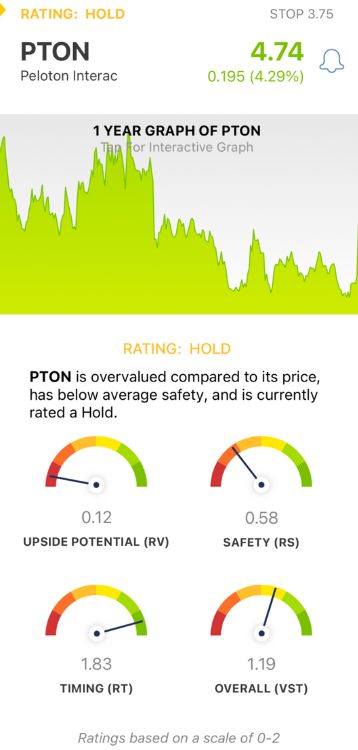

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

It gets even better, though. You’re given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for PTON, here’s what you need to know:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator to the typical comparison of price to value alone. PTON has a very poor RV rating of 0.12.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.58 is poor for PTON.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.83 is excellent for PTON.

The overall VST rating of 1.19 is good for PTON, but does excellent timing outweigh very poor upside potential and safety, or is it the other way around?

The stock is currently rated a HOLD in the VectorVest system - but take a closer look at this opportunity before you do anything else so you can make the most informed decision possible. A free stock analysis is just a few clicks away!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PTON is up more than 50% in the past week on the heels of its first signs of revenue growth in more than 2 years. While the stock still has very poor upside potential and poor safety, the timing is excellent.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment