Palantir Technologies (PLTR) is making waves this week as its shares jumped 13.7% in after-hours trading on Monday, thanks to a standout third-quarter earnings report that exceeded expectations across the board. The company reported a revenue increase of 30%, hitting $726 million—far surpassing Wall Street’s forecast of $704 million. Not to mention, net income reached a record $144 million, doubling from the previous year.

CEO Alex Karp expressed his excitement about the results, citing “unrelenting AI demand” that is reshaping both the defense and commercial sectors. This growth story is backed by solid numbers: U.S. commercial revenue skyrocketed 54% to $179 million, while government revenue also saw a healthy increase of 40%, reaching $320 million.

With these strong results in hand, Palantir has raised its full-year revenue guidance to a range of $2.805 billion to $2.809 billion, an impressive 8% bump from previous estimates. This positive news has analysts buzzing, indicating that Palantir is strategically positioned to take advantage of the increasing interest in AI solutions.

PLTR: A Stock Worth Watching? Here’s What the VectorVest Analysis Reveals

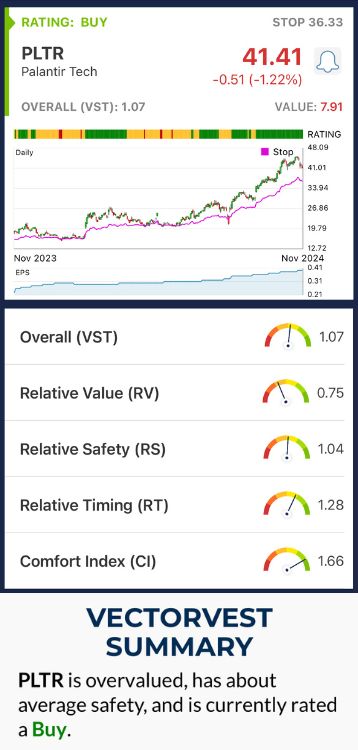

VectorVest is designed to streamline your analysis and help you make data-driven decisions quickly. It breaks down each stock using three key ratings: relative value (RV), relative safety (RS), and relative timing (RT). Here's how PLTR fairs:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3 year price projection), AAA corporate bond rates, and risk. This makes it a far superior indicator than the typical comparison of price to value alone. PLTR has an RV rating of 0.75. This suggests that the stock is overvalued, especially with a calculated value of just $7.81 per share.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. PLTR scores a 1.04 RS rating. This indicates a moderate level of safety, reflecting decent consistency in Palantir’s financial performance.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. PLTR has an excellent RT rating of 1.28, reflecting its strong performance in both the short and long term.

The overall VST rating of 1.07 is good for PLTR and the stock is still rated a buy right now. But before you make your next move, take a moment to review this free stock analysis and set

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PLTR has surged over the past year, but it’s hard to envision this stock slowing down any time soon given the company’s positioning in its industry. It may have poor upside potential, but fair safety and excellent timing earn it a BUY recommendation.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment