It seems as if every day there’s a new company cashing in on AI – and Palantir Technologies (PLRT) is the latest to join the frenzy. The hype around the company’s AI offerings is mounting ahead of next week’s second-quarter earnings report.

The company is known for data analytics and has been working relentlessly to build an “AI fortress” around the business that other companies cannot match. One analyst went as far as to refer to Palantir as the “Lionel Messi of AI”.

While Nvidia may have something to say about that, there is reason to believe that the earnings report next week will be favorable – powered by an unprecedented demand for the company’s suite of AI solutions. Analysts have raised their price targets and estimates for the quarter in anticipation.

CEO Alex Carp has been a strong advocate for AI, going to lengths of discouraging the government from a slowdown in research and development. He says that while collaboration between companies and the US government is important, a halt in R&D could be detrimental to our nation. In fact, he referred to the AI boom as an arms race between nations.

Carp does, however, acknowledge the risk of AI. He feels there should be urgent attention placed on building the technical architecture and regulatory framework around AI.

We last talked about Palantir in May when the company landed a groundbreaking deal with Ukraine, empowering the nation in its fight against Russia. At that time, shares had just gotten a 10% boost and sat at nearly $14/share. Today, the stock sits at just under $20/share.

After rallying more than 156% in the past 3 months, is there still reason to believe that PLTR can continue climbing? Or, will it hit a wall eventually and reverse?

If you’re wondering whether this stock is worth buying ahead of next week’s earnings report, you’re in luck. We’ve put PLTR through the VectorVest stock analyzer and found 3 things you’re going to want to see…

Despite Poor Upside Potential, PLTR Has Fair Safety and Excellent Timing

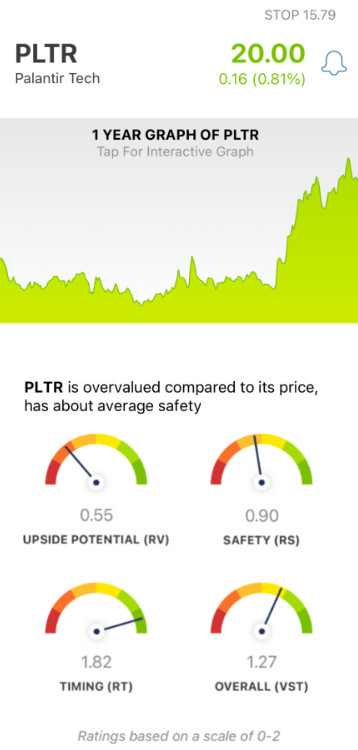

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on a scale of 0.00-2.00, with 1.00 being the average.

With the system, you’re able to uncover and interpret opportunities in the stock market quickly and easily. But, it gets even easier. Because based on the overall VST rating for a stock, you’re offered a clear buy, sell, or hold recommendation - based on real-time conditions. As for PLTR, here’s what we found:

- Poor Upside Potential: The biggest issue for PLTR right now is that the stock’s intrinsic value hasn’t caught up to its share price. The stock is overvalued and has poor upside potential - with an RV rating of just 0.55. This rating compares the stock’s long-term price appreciation potential to AAA corporate bond rates and risk.

- Fair Safety: In terms of risk, PLTR is a fairly safe stock. The RS rating of 0.90 is below the average but speaks to the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: There’s no denying the price trend PLTR has been riding since May. The RT rating of 1.82 is excellent. It’s based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.27 is good for PLTR - but is it enough to earn the stock a buy? Or, should you hold out to see if the hype is substantiated in next week's earnings report?

Get a clear answer on your next move by getting a stock analysis free at VectorVest today. You’re not going to want to miss this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As PLTR climbs higher and higher heading into next week’s earnings report, it’s important to tune out the noise - which is where our system comes in. The stock does have poor upside potential right now, but with fair safety and excellent timing, it’s an interesting opportunity for investors.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment