Nvidia (NVDA) had been on a torrent pace over the past few years and was due for a reversal, which we saw manifest over the past month. The stock fell from $134.93 to just $98 in a 4-week window, prompting the first real bearish outlook on NVDA in as long as we can remember.

But the stock has rebounded well over the week, up nearly 25% to $121.85 per share. Meanwhile, competitors like Intel and Softbank have continued to struggle. It’s clearer than ever that Nvidia is the king of AI chips.

Zooming out and looking at the stock market as a whole, some analysts suggest the Q2 Nvidia earnings that are slated for August 28th could be what the stock market as a whole needs to pull out of its slump.

Goldman Sachs’ Scott Rubner spoke to this, calling Nvidia the most important stock of the year. Rubner suspects the earnings coupled with the Federal Reserve’s Jackson Hole Economic Symposium present a good opportunity to buy the dip.

He did caution, though, that the US presidential election could create turmoil and unpredictability through the second half of September. But, this could give way to new highs heading into the fourth quarter to finish the year strong.

The belief is that Nvidia will deliver another earnings beat alongside optimistic outlooks for the short and long-term roads ahead. CEOs from the world’s biggest tech companies have all made it clear they don’t intend to slow down investments in AI, which will greatly benefit Nvidia.

Plus, we’re starting to see real returns on the initial investments companies have made in AI. This has been a big point of contention as companies like Meta, Alphabet, Microsoft, and more have dumped billions into the technology without seeing an ROI – until now.

We last wrote about NVDA when it began its descent in July. At the time, the VectorVest stock analysis software showed it was still a BUY. Is that the case today, though? Does this actually present an opportunity to buy the dip?

We’ve taken another look at this stock and found 3 reasons NVDA is still a buy.

NVDA Still Has Excellent Upside Potential and Safety With Good Timing

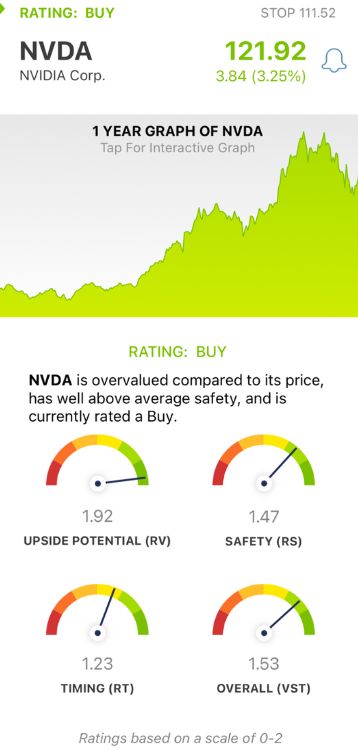

VectorVest simplifies your trading strategy by telling you what to buy, when to buy it, and when to sell it. It does all this through 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. You’re then offered a clear buy, sell, or hold recommendation based on any given stock at any given time based on its overall VST rating. As for NVDA, here’s what we found:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. NVDA is now undervalued after its recent downturn with an RV rating of 1.92.

- Excellent Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. NVDA has an excellent RS rating of 1.47.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. NVDA has a good RT rating of 1.23.

The overall VST rating of 1.53 is excellent for NVDA and the stock is still rated a BUY in the VectorVest system. But to fully capitalize on this opportunity before Q2 earnings, there are a few more things you need to see - take a closer look with a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NVDA may have shown its first real contraction in recent memory, but the road to recovery is well underway, and the stock is poised to pop heading into Q2 earnings in a few weeks. It has excellent upside potential and safety with good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment