Wall Street darling Nvidia (NVDA) is set to declare its earnings results for the first quarter tomorrow on Tuesday, May 22nd. The stock is up more than 2% so far today and nearly 5% in the past week as shareholders are anxiously anticipating an earnings beat.

According to one analyst, the writing is already on the wall and the chip manufacturer will “clearly” outperform the consensus estimates on both top and bottom lines. The current data from Bloomberg is calling for a 400% increase in earnings and a 242% increase in revenue.

Patrick Moorhead, Founder and CEO of Moor Insights & Strategy, says that demand for the company’s chips is off the charts, and development risk remains very low. The only potential issue could be risks in manufacturing with Taiwan Semiconductor Manufacturing Company Limited (TSM).

Another analyst says that the trend we’ve seen NVDA put on through 2024 – up 86% so far – is likely to continue as the company will offer upbeat guidance going forward, too. The company has been on a tear where it raises its guidance and then beats it.

The only downside is the sky-high expectations for the company at this point. Anything less than an overwhelmingly positive earnings day could be interpreted as weakness for Nvidia.

Looking at the consensus around AI technology as a whole, we are rapidly approaching a crossroads where some are starting to question the investment in this technology.

JPMorgan Asset Management global market strategist Jack Manley says the jury is still out on whether or not it will actually change the world in ways thought leaders have suggested.

In the meantime, though, companies like Nvidia will continue to make a killing selling the chips responsible for powering this revolutionary technology.

So, is the obvious play to buy NVDA before tomorrow’s earnings? We’ve found 3 reasons to consider making your entry or bolstering your existing position in the VectorVest stock software.

NVDA Has Excellent Upside Potential and Safety With Very Good Timing

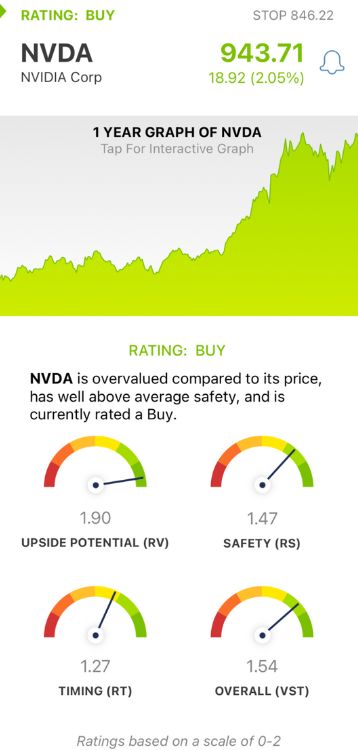

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it based on 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It saves you time and stress while helping you win more trades. But it gets even better.

Based on the overall VST rating for any given stock at any given time, you’re given a clear buy, sell, or hold recommendation. As for NVDA, here’s what you need to know…

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. As for NVDA, the RV rating of 1.90 is excellent.

- Excellent Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, and other factors. NVDA has an excellent RS rating of 1.47.

- Very Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. NVDA has a very good RT rating of 1.27 right now, reflecting its short and long-term performance.

The overall VST rating of 1.54 is excellent for NVDA and enough to earn the stock a BUY recommendation in the VectorVest system.

But before you do anything else, take a moment to analyze this free stock analysis for NVDA so you can make your next move with complete confidence and clarity - you’re not going to want to miss out on this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. All eyes are on NVDA heading into tomorrow’s Q1 earnings day, in which experts are expecting a beat on the top and bottom lines for the AI chipmaker. The stock itself currently has excellent upside potential and safety with very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment