Shares of Nvidia (NVDA) fell as much as 5.6% Thursday after a strong rally sent it on its way to setting a new record high. The stock had climbed more than 6% before all those gains washed away yesterday.

The fall-off could be attributed to the latest inflation figures weighing the stock down – or it could be a slight correction after as much as a 45% hike in share prices in the last 3 months.

Whatever the case, the stock is already back to its usual self, beginning the road to recovery with a 2% gain in Friday’s trading session.

NVDA wasn’t the only stock to fall yesterday, either. Many of its peers in the technology sector saw the same pressure. That includes AMD (down 1.1%), INTL (down 3.9%), and SMCI (down 2.1%).

The consumer price index for June was much cooler than investors had anticipated. Some believe that could mean interest rate cuts are on the way, but others believe that this optimism is already baked into the NVDA price.

Cathie Wood, analyst with ARK Investment Management, believes that Nvidia has underperformed given the high expectations the market has for the chipmaker. Her firm, and some others, have reduced their exposure to NVDA – and lagged behind as a result.

However, Wood used yesterday’s dip to justify her position. She says that customers may begin to rethink AI strategies amidst Nvidia’s high, unfulfilled short-term expectations.

Whether that’s true or not remains to be seen. It could be her attempt to cope with the fact that the ARK Innovation ETF closed its position before the NVDA rally from November 2022 to January 2023, missing out on triple-digit gains.

What we DO know is that we took a look at the stock just last month after news of its partnership with Tesla. At the time, we found that the stock was still a buy. When we look at NVDA through the VectorVest stock software today, we still see 3 reasons to buy it. Here’s what we found…

NVDA Still Has Excellent Upside Potential, Safety, and Timing

VectorVest simplifies your trading strategy by telling you what to buy, when to buy it, and when to sell it, saving you time and stress while helping you win more trades with less work.

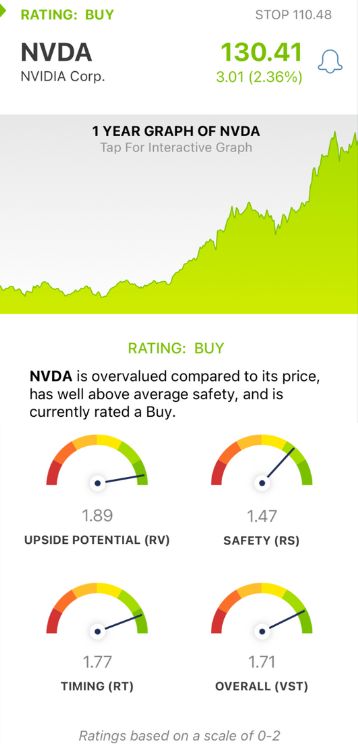

You’re given all the insights you need through 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy.

It gets even easier though. The system gives you a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s the current outlook for NVDA:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a far superior indicator than the typical comparison of price to value alone. NVDA has an excellent RV rating of 1.89.

- Excellent Safety: The RS rating is a risk indicator computed from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. NVDA has an excellent RS rating of 1.47.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of a stock’s price trend. It’s calculated day over day, week over week, quarter over quarter, and year over year. NVDA has an excellent RT rating of 1.77.

The overall VST rating of 1.71 is excellent for NVDA - and the system suggests it’s still time to BUY this stock today. But before you do, take a deeper look at this opportunity so you can fully capitalize - a free stock analysis is just a click away!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NVDA fell in Thursday’s trading session, but has already begun making up the losses today with a 2% gain Friday morning. The stock still has excellent upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment