Shares of Finnish telecommunications company Nokia Oyj (NOK) have fallen roughly 4% so far Thursday morning after an earnings outlook revision for the full year. The road to recovery hasn’t panned out how executives had hoped.

The original operating profit guidance called for somewhere between 2.3 billion and 2.9 billion euros ($2.50 billion – $3.15 billion) for 2024. The company was expecting to come in at the midpoint of that range – but now, they will be happy to hit the bottom end of the outlook.

CEO Pekka Lundmark stated that the original guidance was a bit optimistic and would have necessitated a really solid order intake for the back half of the year. But the third quarter was a bit disappointing, as the market recovery has not been as quick as anticipated.

While net profit attributable to shareholders was up 18% to 352 million euros, sales were down 8.1% to just 4.33 billion euros. Both the top and bottom lines were below the analyst expectations of 356 million euros and 4.7 billion euros respectively.

That being said, Lundmark is upbeat about the company’s prospects going forward. He believes that despite some business segments still struggling, many elements have turned a corner.

One of the reasons Nokia’s sales are being dragged down has to do with the loss of a massive AT&T contract to rival Ericsson. The Swedish telecommunications firm will be deploying its own equipment in place of Nokia throughout North America.

You’ll see two very different stories in comparing Ericsson’s recent earnings performance to Nokia’s. ERIC gained 14% earlier this week after outpacing analyst expectations, while NOK is losing its footing.

It’s not all doom and gloom for the Finnish provider, though. Nokia saw gross margin improvements in its mobile networks business unit to 39.8% compared to 34.8% this time last year.

The company is also working on diversification right now, recently signing a $2.3 billion deal to acquire Infinera – a networking solutions provider. Nokia sees great potential in getting its foot in the data center door, with Lundmark calling this “the #1 growth driver for the coming years.”

Despite today’s setback, NOK is still up 27% through 2024 this year and has been rallying in the right direction over the past months. So, is this earnings letdown and outlook revision reason for investors to sound the alarm? Or, should you stay patient with NOK?

We’ve taken a look in the VectorVest stock analysis software and found 3 things to help you decide.

NOK May Have Poor Upside Potential and Safety, But Timing is Still Good

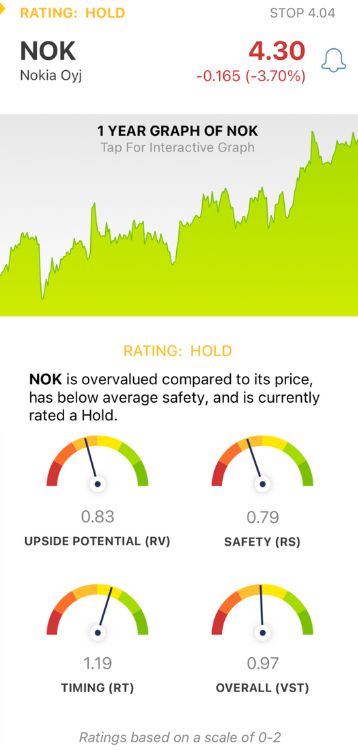

VectorVest is a proprietary stock rating system that simplifies your trading strategy. It distills complex technical and fundamental data into clear, actionable insights, delivering all the information you need to make calculated investment decisions in 3 ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

Better yet, the system issues a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what you need to know for NOK:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a far superior indicator than the typical comparison of price to value alone. NOK has a poor RV rating of 0.83.

- Poor Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.79 is poor for NOK.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. NOK still has a good RT rating of 1.19 even after today’s loss.

The overall VST rating of 0.97 is slightly below the average but deemed fair nonetheless. NOK is still considered a HOLD in the VectorVest system.

If you want to learn more about this situation, though, a free stock analysis is just a click away. See firsthand how VectorVest can transform your trading strategy for the better today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NOK had to walk back its full-year earnings forecast after a disappointing third quarter performance. The stock may have poor upside potential and safety, but it still has good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment