Nio (NIO) revealed a new vehicle design yesterday that left a lasting impression, sending shares more than 11% higher at one point after the long holiday weekend. The stock has experienced a slight correction in this morning’s trading session, as it’s down more than 3% so far.

The ET9 as it has been called is a “Smart Electric Executive Flagship” according to Nio. It’s certainly not for everyone at a price of $112,000, but there’s a reason for this luxury price tag.

The 4-seat design has been referred to as a “vehicular first-class experience”, with each seat designed as its own space. What really has investors and car enthusiasts excited, though, is the tech that powers this vehicle. It’s mostly proprietary technology that NIO themselves have designed.

This is important as automakers that employ their own technology are more sought after by investors. You can look at Tesla as exhibit A, as the US EV maker is outpacing rivals with similar fundamentals that have to outsource their technology.

We won’t see the ET9 hit the road until early 2025, but the hype is already well underway. The Chinese EV maker is ramping up deliveries of other vehicles in the meantime, with 142,000 units delivered so far this year as of November. That’s a 33% growth year over year.

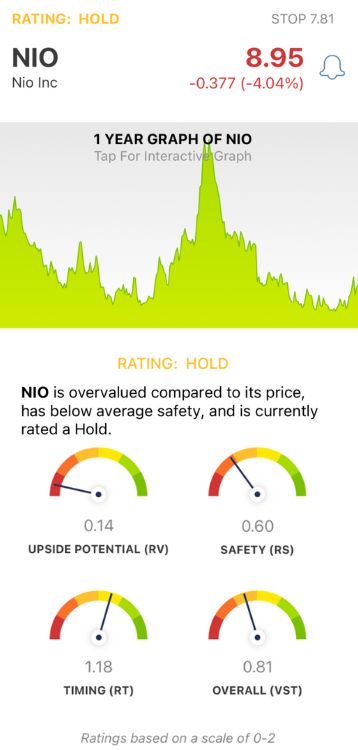

This news came after NIO announced a $2.2 billion investment from an Abu Dhabi group just a few weeks ago, which sent shares 5% higher. When we wrote about this news, the stock was still a HOLD in the VectorVest stock analysis software.

But, does the buzz around the ET9 change things? We’ve refreshed our viewpoint on NIO and have 3 things you need to see below.

NIO Still Has Very Poor Upside Potential and Safety, But Now It Has Good Timing Pushing the Stock Higher

VectorVest has outperformed the S&P 500 index by 10x over the past 20 years and counting. It’s a proprietary stock rating system that simplifies your trading strategy, empowering you to win more trades with less work.

You’ve given clear, actionable insights in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

It gets even easier, though. VectorVest offers a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for NIO, here’s what you need to know:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. It offers much better insight than a simple comparison of price to value alone. As for NIO, the RV rating is still very poor at 0.14, slipping a bit more since we last wrote about it.

- Poor Safety: The risk profile has improved slightly for NIO in the past few weeks, as the stock’s RS rating is now 0.60 - which is still poor, but better than the 0.58 we saw previously. This risk indicator comes from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other factors.

- Good Timing: The biggest change since we last wrote about NIO is the strong price trend that’s formed. The stock has now good timing with an RT rating of 1.18. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.81 is still poor for NIO, but it’s improving. That being said, it’s still not time to buy this stock - VectorVest maintains the HOLD recommendation. Learn more through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NIO revealed a stunning new vehicle design with proprietary technology, sending shares higher in Tuesday’s trading session. The stock still has very poor upside potential and poor safety, but its timing is good now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment