Shares of Netflix (NFLX) have climbed more than 10% in the last week after its latest upgrade – this time, by Bank of America. Analyst Jessica Reif Ehrlic raised her price target from $410 to $490, implying a 15% climb.

This comes after Netflix shared 3rd party data showing positive results for the upcoming password-sharing crackdown. It’s no secret that the company is losing revenue opportunities to freeloaders. But, just how much opportunity exists is astounding.

Last Friday, the company said that sign-ups boomed as the password crackdown went into effect. Over a four-day span, the streaming service brought in more than 100k new users – the most in the last 4 and half years. It’s been said that password sharing could represent $2b in incremental annualized revenue opportunity.

BoA isn’t the only firm to take a more bullish stance on this stock, either. Wells Fargo, JPMorgan, and Pivotal Research were optimistic about this stock first, each of which raised their price targets already. At the low end, these firms expect the price to appreciate to $470. But, some analysts have it reaching as high as $535.

Part of the hype around this stock can also be attributed to the ad-supported tier, which offers an opportunity to increase engagement and reach a more diverse demographic. While some freeloaders will not return to the service, others will opt for the cheaper $6.99 tier and be served ads – which creates other revenue streams from ad buyers all at once.

All things considered, there’s a lot to be excited about as it pertains to Netflix. The company also plans to open a pop-up restaurant in LA sometime soon, and there is rumored progress in the sports live-streaming segment as well.

But, is the rising hype reason enough to add NFLX to your portfolio? We’re going to help you tune out the noise and just focus on what really matters from an investment standpoint. Below, we’ve analyzed the stock through the VectorVest stock forecasting software. There are 3 things you need to see before you do anything else…

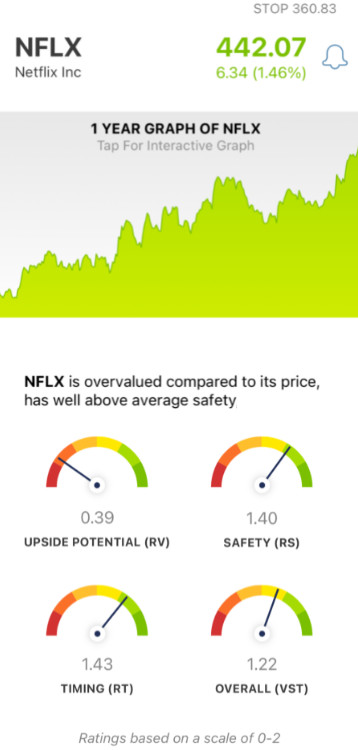

While NFLX Still Has Very Poor Upside Potential, the Safety and Timing are Excellent

The VectorVest system helps you simplify your trading strategy by giving you clear, actionable insights in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. This allows for quick and easy interpretation, helping you win more trades with less work and time commitment.

But, it gets even easier. Because based on the overall VST rating for a stock, the system offers a buy, sell, or hold recommendation at any given time. As for NFLX, here’s what we found:

- Very Poor Upside Potential: The RV rating looks at a stock’s 3-year price appreciation potential compared to AAA corporate bond rates and risk. And right now, the RV rating of 0.39 is poor for NFLX. Moreover, the stock is overvalued - with a current value of just $110.

- Excellent Safety: In terms of risk, NFLX has excellent safety - with an RS rating of 1.40. This is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: As you can see by how the stock has been trending recently, there is a positive price trend with wind in its sails. The excellent RT rating of 1.43 is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.22 is good for NFLX - but is it enough to earn the stock a buy? Or, is the very poor upside potential still holding the stock back enough to justify waiting a bit longer?

Don’t let guesswork or emotion prevent you from capitalizing on this opportunity - get a clear buy, sell, or hold recommendation based on a tried and true approach to stock analysis today. Your free stock analysis is just a few clicks away at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for NFLX, the stock has very poor upside potential - but excellent safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment