Meta (META) announced its plans to invest aggressively in AI Wednesday, hoping to harness the power this technology claims to offer as a means to compete with Google and Microsoft. However, the news sparked investor uncertainty as shares initially tanked 15%. They’ve settled at a loss of around 12% Thursday morning.

The announcement came as part of the company’s first-quarter earnings which saw a massive improvement in profit in revenue alike. Profits were doubled year over year while revenue climbed 27%.

But, shareholders realize that the whopping $5 billion investment Meta plans to make in AI will take years to pay dividends. We’ve seen countless other companies invest heavily in this technology over the past few years with no return on investment yet. That’s where the investor concern comes in.

The AI hype has been impossible to ignore over the past few years, but it’s coming to a point where it’s time to prove that this technology can generate a return for companies like Meta.

It’s also worth noting that while Meta focuses on AI, attention will be stolen from its core business activities – generating advertising revenue. An analyst with Hargreaves Lansdown, Sophie Lund-Yates, spoke to this saying that despite the market share and resource base Meta has, it could end up spreading itself too thin here.

While the $5 billion AI investment sounds like a lot, it’s a fraction of the company’s full-year capital expenditure plans. The previous range of $30-37 billion has been updated to $35-40 billion.

On top of the negative sentiment surrounding AI, though, the company’s guidance for Q2 left a bit to be desired. Analysts are expecting revenue of $38.2 billion, and Meta will have to deliver at the top end of its range of $36.5-39 billion to meet that.

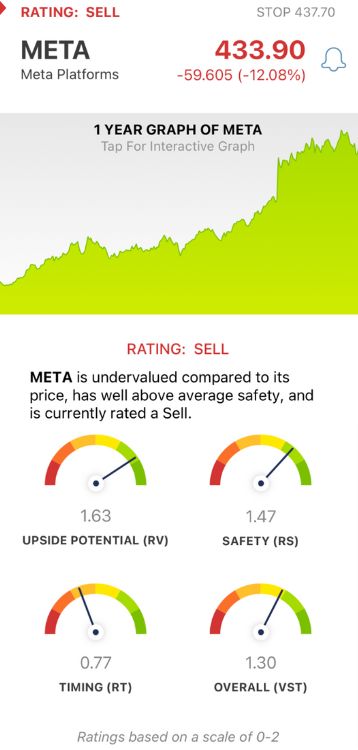

META has performed well through 2024 thus far despite today’s tanking, as the stock is still up 22% YTD. But, we’ve taken a look through the VectorVest stocks software and found a few reasons investors may want to take profits and SELL this stock. Here’s what you need to know.

META Still Has Excellent Upside Potential and Safety, But Poor Timing Means It’s Time to SELL

VectorVest saves you time and stress by giving you all the insights you need to make calculated decisions and win more trades in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy. Better yet, investors are given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for META, here’s what we found:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. This is a far superior indicator than the standard comparison of price to value alone. META has an excellent RV rating of 1.63 right now.

- Excellent Safety: The RS rating is a risk indicator computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. META has an excellent RS rating of 1.47.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. META has a poor RT rating of 0.77, suggesting a strong negative price trend has taken hold of the stock after yesterday’s news.

The overall VST rating of 1.30 is very good for META - but the poor timing is enough to earn this stock a SELL rating in the VectorVest system. You can learn more about this situation before you make your next move through a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. META delivered a solid first-quarter performance and was eager to share its plans to spend aggressively on AI technology - but investors are concerned about this investment. The stock itself has excellent upside potential and safety with poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment