Macy’s (M) is up nearly 5% so far Tuesday morning after the retailer announced its Q4 earnings results along with its plans to rejuvenate the brand through a series of store closures, asset sales, and more.

For the quarter ended on February 3rd, the company narrowed its loss to just $71 million from $508 million this time last year. Adjusted earnings per share easily beat the FactSet consensus at $2.45 compared to $1.98.

While revenue was down 2.4% to $8.38 billion, Macy’s still outperformed compared to the expectation of just $8.09 billion according to FactSet.

But, the real takeaway from the company’s press release barrage was its resurgence plan. Macy’s intends to close 150 unproductive stores by 2026 to trim the fat, as these account for about 25% of real estate square footage but contribute to less than 10% of sales.

50 of these stores will be closed by the end of the year. These closures have resulted in a $1 billion charge. Meanwhile, the company will double down on what it sees working, investing in nearly 350 existing stores.

There is also going to be a focus on modernizing the shopping experience for customers. The biggest assets for Macy’s have been its luxury brands Bloomingdale’s and Bluemercury, and the intention is to lean into that segment.

Looking ahead, the company has set its sights on monetizing up to $750 million in supply chain assets. This will fuel the growth that execs are calling for. Speaking of which, Macy’s plans to deliver adjusted earnings between $2.45 to $2.85 for fiscal 2024. The FactSet consensus is forecasting $2.77.

As the stock has now gained 36% over the last 3 months, it’s becoming harder and harder to ignore M’s trajectory. So, is this an opportunity for investors to trade the stock at a discount to its historical price? We’ve taken a look through the VectorVest stock software to find out.

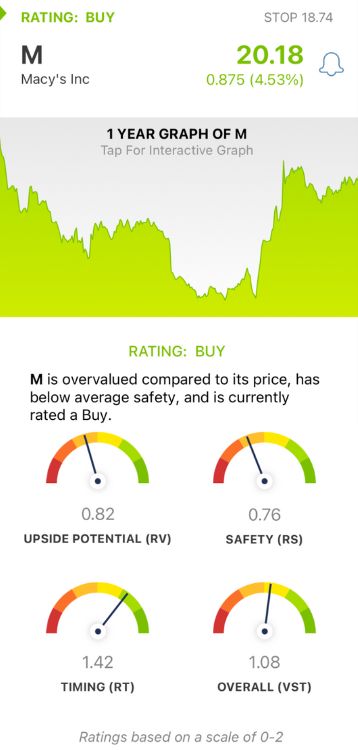

M May Have Poor Upside Potential and Safety, but the Stock Also Has Excellent Timing

VectorVest is a proprietary stock rating system that simplifies your trading strategy, empowering you to increase your returns and win rate with less time and effort.

It eliminates stress, uncertainty, and human error from your decision-making by giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy - pick stocks with higher ratings to win more trades with less work. It gets even easier, though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for M:

- Poor Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. As for M, the RV rating of 0.82 is poor.

- Poor Safety: The RS rating is a risk indicator. It’s derived from a detailed analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. M has a poor RS rating of 0.76 right now.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of a stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. This is where things get interesting because M has an excellent RT rating of 1.42.

The overall VST rating of 1.08 is fair, and it’s enough to earn M a BUY recommendation in the VectorVest system. That being said, we encourage you to learn more about this opportunity before doing anything else - get a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. M is up nearly 5% Tuesday after a solid Q4 earnings report alongside excitement surrounding the company’s resurgence plans. The stock may have poor upside potential and safety, but its timing is excellent.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment