Lululemon Athletica (LULU) reported strong third-quarter results that beat Wall Street’s expectations, giving investors a reason to be optimistic. The company posted revenue of $2.4 billion, a 9% increase from last year, and adjusted earnings per share of $2.87, above the forecast of $2.75. However, concerns remain as U.S. sales continue to slow, unable to keep pace with the company’s international growth.

While U.S. same-store sales fell 2%, the company saw a 33% boost in international markets, helping to balance things out. CEO Calvin McDonald remains confident, highlighting the positive momentum overseas and the company’s efforts to revive its U.S. business. As the holiday season approaches, Lululemon is focused on maintaining its strong brand and increasing awareness.

Despite facing stronger competition from emerging brands like Alo Yoga and Vuori, Lululemon has raised its revenue and earnings outlook for the year. Although shares are down 33% so far this year, the company’s recent performance offers hope for a recovery.

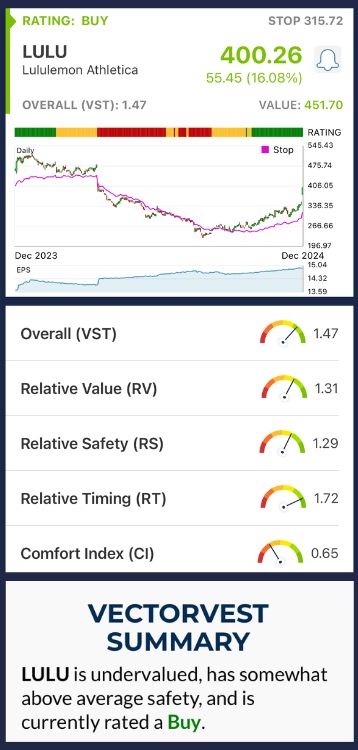

LULU Has Excellent Upside Potential, Very Good Safety, and Excellent Timing

VectorVest is a proprietary stock rating system that simplifies stock analysis into three clear ratings, making it easier to make calculated investment decisions. The system has consistently outperformed the S&P 500 index over the last 20 years, delivering actionable insights based on relative value (RV), relative safety (RS), and relative timing (RT).

These ratings sit on a scale from 0.00-2.00, with 1.00 being the average, allowing for quick and easy interpretation. Additionally, VectorVest provides a buy, sell, or hold recommendation based on the overall VST rating for any stock. Here’s what we found for Lululemon Athletica (LULU):

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year forecast), AAA corporate bond rates, and risk. LULU has an excellent RV rating of 1.31, indicating strong long-term growth potential.

- Very Good Safety: The RS rating assesses the company’s financial consistency, debt-to-equity ratio, business longevity, and other factors. LULU has a very good RS rating of 1.29, which reflects strong financial stability and lower risk compared to its peers.

- Excellent Timing: The RT rating measures the stock’s price momentum, looking at short-term price movements. LULU has an excellent RT rating of 1.72, indicating strong short-term momentum and positive market sentiment.

With an overall VST rating of 1.47, LULU’s stock is rated a BUY. If you’re a current investor or looking for an opportunity to trade this stock, get a free stock analysis at VectorVest today for more insights and to transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks that are rising in price. Lululemon (LULU) faces increased competition and some slowdown in North America, but strong international growth keeps its upside potential intact. While challenges remain, the stock’s solid fundamentals and positive momentum make it a strong growth candidate in the athletic wear sector.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment