Lowe’s (LOW) reported second-quarter earnings today that sent mixed messages – while the home improvement store beat earnings expectations, sales were down.

The company is expecting to fall short of its original guidance for the full year now, which has sent shares slightly down in Tuesday morning trading. Here’s how the company finished Q2:

- Adjusted earnings per share: $4.10 compared to $3.96 consensus.

- Total sales: $23.59 billion compared to $23.93 billion consensus.

The sales figure represented a 5.5% decline year over year. Comparable sales specifically fell 5.1%, which was worse than the 4.4% decline that was being forecasted.

This could be attributed to poor weather delaying DIY projects for homeowners and a more conservative customer less willing to pay for bigger ticket items. However, the companies Pro and online segments buoyed this negative performance to a certain degree.

Looking ahead to the remainder of the year, Lowe’s had to revisit its sales guidance. It’s now expected to deliver revenue in the range of $82.7 to $83.2 billion. The previous guidance called for $84 to $85 billion.

Earnings got cut too – now, the adjusted EPS guidance sits at $11.70 to $11.90 compared to the previous guidance of $12.00 to $12.30.

This news comes on the heels of rival company Home Depot lowering its fiscal guidance for 2024 as well. Home improvement as a whole is seeing demand drop – which could raise concerns for the economy as a whole.

Analysts point to a soft housing market, macroeconomic uncertainty, normalizing performance in a post-pandemic reality, the election, and the Fed all playing a role in this issue.

That being said, LOW was rallying higher heading into this news – the stock is up 5% in the past week. It’s gained nearly 10% through 2024 thus far. So, where does all this leave investors?

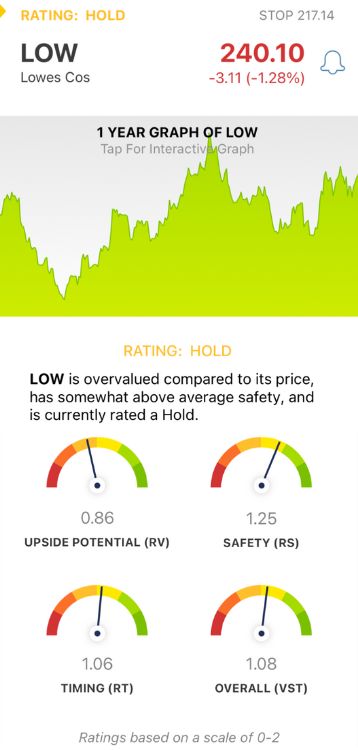

We’ve taken a look at this stock through the VectorVest stock analysis software and have 3 things you need to see before you do anything else.

LOW Has Fair Upside Potential and Timing With Very Good Safety

VectorVest simplifies your trading strategy through a proprietary stock rating system that delivers clear, actionable insights in 3 ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT), and they tell you everything you need to know to make calculated, emotionless investment decisions.

Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. You’re even given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for LOW, here’s what you need to know:

- Fair Upside Potential: The RV rating is a far superior indicator than the typical comparison of price to value alone. It compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. LOW has an RV rating of 0.86 which is fair, albeit a ways below the average.

- Very Good Safety: The RS rating is a risk indicator. It’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.25 is good for LOW.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. LOW has a fair RT rating of 1.06.

The overall VST rating of 1.08 is deemed fair for LOW and earns the stock a HOLD recommendation for the time being. Whether you’re looking for an opportunity to trade this stock or have an open position right now, take a moment to dig deeper with this free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. LOW is down slightly in Tuesday trading after a mixed bag of earnings that saw an earnings beat but sales fall short. The company had to walk back its guidance for the full year as well. The stock itself has fair upside potential and timing with very good safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment