Lovesac Co. (LOVE) has gained more than 24% so far Thursday morning after delivering a somewhat mixed bag for the second quarter of fiscal 2025. The company saw sales climb, yet profits shrunk.

Still, the company managed to beat the analyst expectations on both the top and bottom lines for Q2. The loss of $0.38 per share was much wider than this time last year (just $0.04 per share), but analysts were anticipating a loss of $0.44 per share.

Sales grew 1.3%, leading to a total revenue of $156.5 million compared to the analyst’s consensus of 1.43 million. Part of this performance was driven by growth in internet sales of 7%, but the company also opened 10 new showrooms during the quarter.

Lovesac also saw a positive response to new product rollouts, including the PillowSac Accent Chair and AnyTable.

But, the profitability concerns are impossible to ignore. Gross margin slipped 80 basis points to just 59% as SG&A expenses climbed more than 15% for the quarter.

CEO Shawn Nelson says the industry backdrop was challenging for the quarter, and that he still believes the company is well-positioned to meet short and long-term goals.

Speaking of which, the company updated its full-year 2025 forecast. Now, it’s calling for net sales in the range of $700 to $735 million with diluted earnings per share of $1.01 to $1.26. This suggests the second half of fiscal 2025 will be far better than the first.

LOVE had fallen 18% over the past few months heading into today’s earnings update. The pop we saw this morning recovered all those losses and then some, but the stock still sits relatively flat through 2024 thus far.

So, where does all this leave current or prospective investors – should you buy LOVE on the heels of this news? Before you do anything else, take a moment to look at these three things we found in the VectorVest stock analysis software.

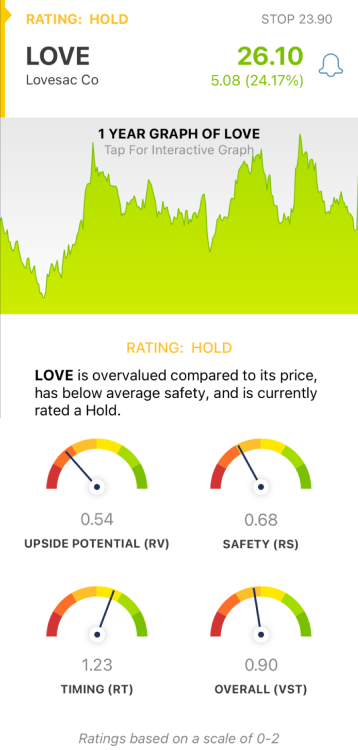

LOVE Has Poor Upside Potential and Safety Despite Good Timing

VectorVest helps you win more trades with less work and stress by giving you all the insights you need to make calculated, emotionless investment decisions in 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

But it gets even better, as you’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for LOVE, here’s what we found:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This makes it a far superior indicator to the typical comparison of price to value alone. LOVE has a poor RV rating of 0.54. The stock is currently overvalued with a current value of just $11.82/share.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. LOVE has a poor RS rating of 0.68.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. LOVE has a good RT rating of 1.23, reflecting its recent performance.

The overall VST rating of 0.90 is a bit below the average, but still deemed fair. It’s not enough to earn the stock a buy recommendation, though. LOVE is currently rated a HOLD in the VectorVest system.

But, there’s a bit more to the story that investors need to be aware of. So, take a moment to dig deeper with this free stock analysis so you can make the most informed trading decision!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. LOVE has gained more than 24% so far Thursday morning after reporting Q2 earnings that beat the analyst consensus on the top and bottom lines, despite profitability challenges. The stock has poor upside potential and safety with good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment