JPMorgan analyst Doug Anmuth recommends that clients “buy pullbacks” because Netflix is still a smart buy. His recommendation comes despite consumer complaints over Netflix’s crackdown on password sharing, concerns over short-term subscription decay, and a declining stock price.

Although Netflix reached a YTD peak of $369.02 per share on January 26, shares slumped nearly 4% since the company’s fourth-quarter earnings results and have lost more than 17% of their gains. Last month, Netflix took a hit on Wall Street after cutting pricing by 50% in nearly 100 markets abroad.

Despite its movement, Anmuth believes the company has a $390 12-month price target attributable to desirable content, strong advertising, and password sharing that will spark 2023 revenue, cash flow, and market growth.

Anmuth acknowledged the short-term concerns but reiterated that they remain bullish and “buying NFLX for 12 months out may be easier than for the next 3-4 months.”

Further, Anmuth predicts that games will be another critical component for Netflix as it seeks to establish additional income potential. In a blog post published on Monday, Netflix revealed that it has 70 games in production with partners and 17 in-house. In total, Netflix has published 55 games to date, with 40 more expected to be launched by the end of the year.

Despite the positive outlook, JPMorgan’s Anmuth cautioned that short-term noise and negative headlines could obscure investor sentiment, particularly as Netflix considers the implementation of its password-sharing crackdown on a broader scale.

Anmuth expressed concern that initial complaints related to password sharing could affect the rollout, potentially extending into the second quarter and beyond.

Nevertheless, Netflix’s quarterly shareholder letter in January announced plans to combat password sharing during the first quarter but did not specify the timing or scope of the initiative.

Netflix expanded its password-sharing crackdown to Canada, Spain, Portugal, and New Zealand, in addition to Chile, Costa Rica, and Peru test countries. So far, it has yet to announce a plan for U.S. users.

However, Anmath anticipates Netflix’s projected subscriber increase in the second quarter due to password crackdowns will be met with more pushback than during the first quarter.

JPMorgan anticipates 1.5 million subscribers for Q1 and 3.25 million for Q2. On the other hand, a slower password-sharing enforcement timeline could yield better-than-expected net additions for the first quarter.

Netflix will publish its Q1 results on April 18.

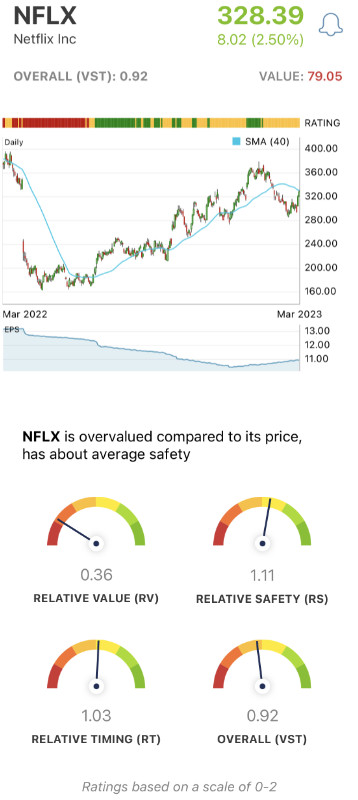

Weighing NFLX’s Good Safety and Fair Timing Against Very Poor Upside Potential

The VectorVest system simplifies your trading strategy by giving you all the insights you need in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Interpreting these is easy as they sit on a scale of 0.00-2.00 with 1.00 being the average.

VST is the master indicator for ranking every stock in the VectorVest database. NFLX has a VST rating of 0.92, which is fair on a scale of 0.00 to 2.00. VST is computed from the square root of a weighted sum of the squares of RV, RS, and RT. Stocks with the highest VST ratings have the best combinations of Value, Safety and Timing.

- Very Poor Upside Potential: RV is an indicator of long-term price appreciation potential. NFLX has an RV of 0.36, which is very poor on a scale of 0.00 to 2.00. This indicator is far superior to a simple comparison of Price and Value because it is computed from an analysis of projected price appreciation three years out, AAA Corporate Bond Rates, and risk.

- Good Safety: RS is an indicator of risk. NFLX has an RS of 1.11, which is good on a scale of 0.00 to 2.00. RS is computed from an analysis of the consistency and predictability of a company's financial performance, debt to equity ratio, sales volume, business longevity, price volatility and other factors.

- Fair Timing: RT analyzes a stock's price trend. NFLX has a Relative Timing of 1.03, which is fair on a scale of 0.00 to 2.00. RT is computed from an analysis of the direction, magnitude, and dynamics of a stock's price movements day-over-day, week-over-week, quarter-over-quarter and year-over-year. If a trend dissipates, RT will gravitate toward 1.00.

All of this works out to an overall VST rating of 0.92—which is fair. Does it earn NFLX a buy in the VectorVest system, though? To get a clear answer on your next move with this stock use our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for NFLX, it is overvalued with very poor upside potential compared to its price, has good safety and fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment