The fourth quarter of the year was strong for JP Morgan Chase & Co. (JPM). The company exceeded analyst expectations, and even beat out its own performance in the 4th quarter last year – despite unfavorable economic conditions.

The quarterly earnings came in at $3.57/share, exceeding the anticipated earnings of just $3.11/share. This was a $0.24 gain per share from the same quarter last year. This is the second time in the last year that the company overperformed compared to what analysts expected. And, it wasn’t just earnings that impressed shareholders and analysts alike.

JP Morgan Chase & Co. also topped revenue estimates by 1.75%, reporting $34.55 billion. This is a dramatic increase over the same period last year when the company reported just $29.26 billion in revenue.

While the stock is down almost 16% in the last 365-day period, it does look as if the stock is forming momentum in the right direction. The stock has surged over 26% in the past 3-month period. And upon the release of this earnings report, shares are trading over 2% higher. So far in 2023, JPM is outperforming the S&P 500 with a gain of about 4%.

With that said, is now a good time to buy JPM stock? It’s hard to know what the future will hold for this company, especially because management has yet to provide commentary on the earnings report. We’ll have a better idea of what’s to come for JPM after that call.

However, through the VectorVest stock forecasting software, we’ve identified three key indicators you can rely on to help you make your next move with confidence.

JPM Has Good Upside Potential, Fair Safety, and Excellent Timing

The VectorVest system changes the way you find and execute opportunities in the stock market – as it tells you what to buy along with when to buy it and when to sell it. The system has outperformed the S&P 500 by 10x over the last few decades – all while simplifying your trading strategy and eliminating human error, guesswork, and emotion.

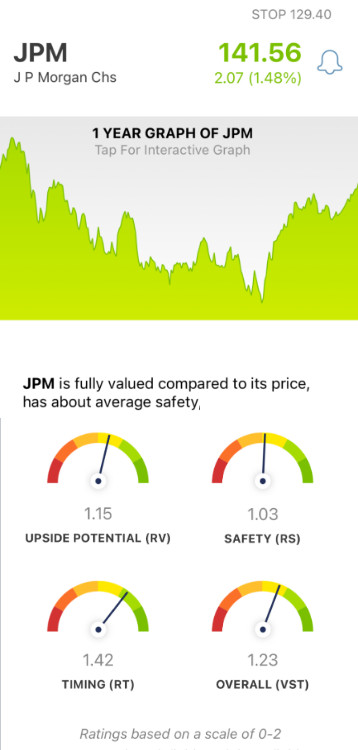

It’s all possible through three intuitive ratings: relative value (RV), relative safety (RS), and relative timing (RT). These are placed on a scale of 0.00-2.00 – with 1.00 being the average. Ratings over the average indicate overperformance and vice versa.

The best part, though, is that VectorVest provides a clear buy, sell, or hold recommendation for a stock based on these three ratings – including JPM. Here’s what you need to know about this stock right now:

- Good Upside Potential: The RV rating analyzes a stock’s long-term price appreciation potential 3 years out compared to AAA corporate bond rates and risk. As for JPM, the RV rating of 1.15 is good. Moreover, the stock is fully valued at its current price point.

- Fair Safety: In terms of risk, JPM is a fairly safe stock. The RS rating of 1.03 reflects that – and is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: As you can see on the stock’s 3-month chart, a strong price trend is forming for JPM – and the excellent RT rating of 1.42 confirms this. This rating is based on the direction, dynamics, and magnitude of a stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

These three ratings contribute to an overall VST rating of 1.23 for JPM – which is good. Does that mean this stock is a buy right now – or should you wait for more definitive price trend validation? Get a clear answer on your next move through a free stock analysis today – don’t miss this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for JPM, it is fully valued with good upside potential. The stock is fairly safe and has excellent timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment