Pfizer (PFE) has climbed more than 2% in this shortened trading week, and this could be due to the recent advancements in their latest vaccine. The RSV (respiratory syncytial virus) vaccine has been found to be 82% effective in preventing a respiratory virus in infants.

The way the vaccine works is through administration to the mother during pregnancy. At that point, it works to block RSV from developing in infants. While adults suffer from mild symptoms that could be compared to the common cold, the virus has life-threatening consequences in newborns.

Preliminary results are showing that Pfizer’s vaccine is as high as 82% effective at preventing RSV for the first 3 months of birth. While effectiveness falls off to a mere 69% after 6 months, these results are still promising. Especially for a company that has been battered and bruised from the fading of COVID-19.

But, Pfizer isn’t letting their fall from grace discourage them by any means. They’ve recently acquired Seagen to address upcoming patent expirations – with the goal of adding more than $10 billion in revenue before 2030.

Plus, the company benefited from an FDA-approval for a two-drug combination against lung cancer earlier this month. This is coming off a big win last month in which the company saw favorable outcomes in its prostate cancer treatment drug.

All things considered, it seems as if Pfizer is stacking up wins left and right. And after an abysmal start to the year in which the company lost more than 16%, could this be the turnaround investors have been waiting for? Is now a good time to add PFE to your portfolio?

Below, we’ll highlight 3 things you need to see before buying or selling this stock. By using these insights from the VectorVest stock analyzing software, you can feel confident in your next move – no matter what that may be.

PFE Has Fair Upside Potential, Safety, and Timing Right Now

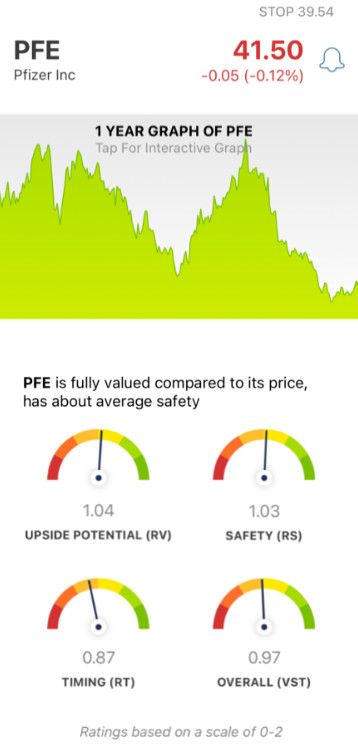

The VectorVest system simplifies your trading strategy by providing you with all the insights you need in just three ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting these ratings and making a decision based on them is quick and easy. Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. But, it gets even better - because based on these ratings, VectorVest is able to provide you with a clear buy, sell, or hold recommendation for any given stock, at any given time. As for PFE, here’s what’s going on right now:

- Fair Upside Potential: The RV rating assesses a company’s three-year price projection in comparison to AAA corporate bond rates and risk. As for PFE, the RV rating of 1.04 is fair - just above the average. The stock is currently fully valued.

- Fair Safety: PFE is a fairly safe stock right now with an RS rating of 1.03. This is based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: While the RT rating of 0.87 is below the average, it’s still considered fair. This rating is derived from the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. While PFE has a big hole to climb out of, it appears that a more favorable price trend could be forming as we speak.

The overall VST rating for PFE is fair at 0.97 - but it is just below the average. So, what does that mean for investors? Should you hold on a bit longer to see if the price trend we’ve witnessed this week holds and gains traction? Or, should you buy or sell now?

Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for PFE, it has fair upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment