Palantir Technologies (PLTR) has had a great run in 2024, jumping 344% mainly after a strong earnings report and a big defense contract. But with such a huge rise, investors are asking: Is there still more growth left, or has it peaked?

Several things are at play, especially Palantir’s push into AI. The company, known for its data analytics, is focusing on government and defense contracts where AI solutions are in high demand. This has led to new partnerships, like the $36.8 million deal with the U.S. Special Operations Command and ties with big companies like Booz Allen Hamilton and L3Harris.

However, there are concerns. Palantir still depends a lot on government contracts for revenue, and some wonder if the company can scale AI into commercial markets.

On the plus side, Palantir’s balance sheet is solid with no debt and plenty of cash, allowing it to keep investing in growth. Plus, its AI platform is expanding, which could bring future rewards.

So, is now the time to buy PLTR? Let’s see what the VectorVest stock analysis says.

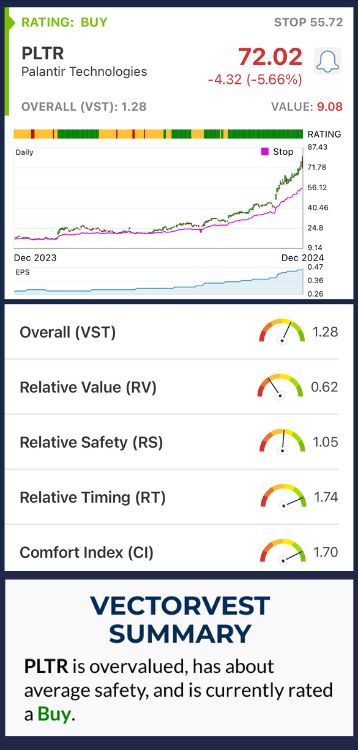

PLTR Has Poor Upside Potential, But Fair Safety and Excellent Timing

VectorVest is a proprietary stock rating system that distills complex technical and fundamental data into 3 simple ratings, saving you time and stress while empowering you to win more trades.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

You’re even given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what you need to know about PLTR:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a far superior indicator than the typical comparison of price to value alone. PLTR has a poor RV rating of 0.62

- Fair Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.05 is fair for PLTR.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s analyzed day over day, week over week, quarter over quarter, and year over year to paint the full picture for investors. Palantir’s RT rating is 1.74.

With an overall VST rating of 1.28, PLTR is still rated a BUY. However, the stock faces challenges in scaling its AI business and might struggle to maintain its current momentum. Be sure to review the latest stock analysis before making your move.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest recommends buying safe, undervalued stocks that are rising in price. PLTR’s impressive 2024 performance has caught the attention of investors, driven by AI adoption and expanding government contracts. However, while the stock has surged, its upside potential remains limited, with fair safety and strong timing. The future demand trend is uncertain, making it a stock to watch closely.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment